- India

- /

- Capital Markets

- /

- NSEI:5PAISA

If You Like EPS Growth Then Check Out 5paisa Capital (NSE:5PAISA) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like 5paisa Capital (NSE:5PAISA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for 5paisa Capital

How Fast Is 5paisa Capital Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that 5paisa Capital grew its EPS from ₹0.77 to ₹6.00, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

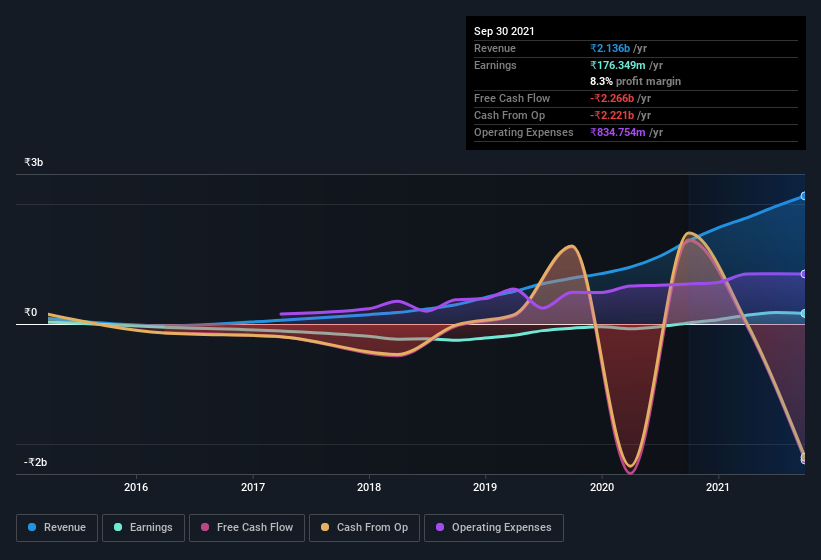

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that 5paisa Capital's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note 5paisa Capital's EBIT margins were flat over the last year, revenue grew by a solid 54% to ₹2.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

5paisa Capital isn't a huge company, given its market capitalization of ₹13b. That makes it extra important to check on its balance sheet strength.

Are 5paisa Capital Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own 5paisa Capital shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at ₹4.2b, they have plenty of motivation to push the business to succeed. That holding amounts to 32% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like 5paisa Capital with market caps between ₹7.4b and ₹30b is about ₹13m.

5paisa Capital offered total compensation worth ₹10m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add 5paisa Capital To Your Watchlist?

5paisa Capital's earnings have taken off like any random crypto-currency did, back in 2017. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. 5paisa Capital certainly ticks a few of my boxes, so I think it's probably well worth further consideration. What about risks? Every company has them, and we've spotted 1 warning sign for 5paisa Capital you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:5PAISA

5paisa Capital

Provides an online technology platform for trading in National Stock Exchange of India Limited, BSE Limited, and MCX.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives