- India

- /

- Consumer Services

- /

- NSEI:UMESLTD

Does Usha Martin Education & Solutions (NSE:UMESLTD) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Usha Martin Education & Solutions (NSE:UMESLTD). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Usha Martin Education & Solutions

How Fast Is Usha Martin Education & Solutions Growing Its Earnings Per Share?

Over the last three years, Usha Martin Education & Solutions has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Usha Martin Education & Solutions's EPS soared from ₹0.0096 to ₹0.012, in just one year. That's a impressive gain of 25%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Usha Martin Education & Solutions's EBIT margins have actually improved by 12.9 percentage points in the last year, to reach 14%, but, on the flip side, revenue was down 12%. That's not ideal.

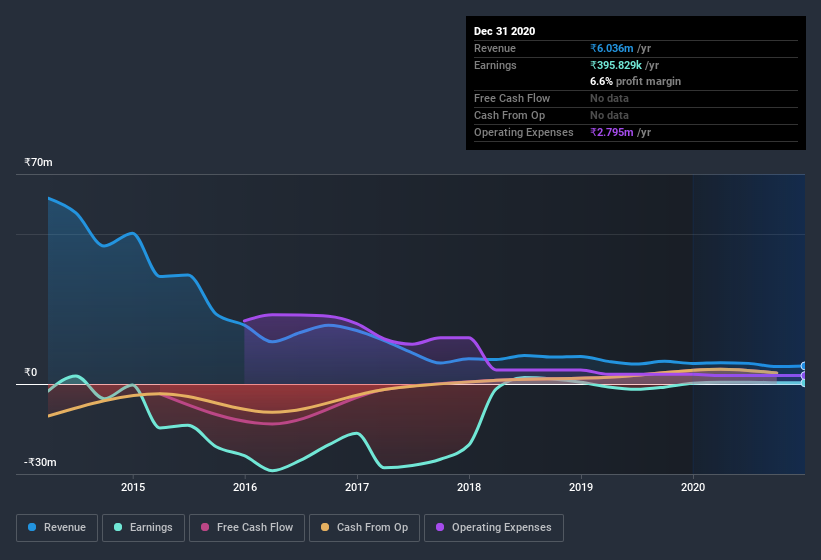

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Usha Martin Education & Solutions is no giant, with a market capitalization of ₹92m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Usha Martin Education & Solutions Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations under ₹15b, like Usha Martin Education & Solutions, the median CEO pay is around ₹3.1m.

The Usha Martin Education & Solutions CEO received total compensation of only ₹1.3m in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Usha Martin Education & Solutions Worth Keeping An Eye On?

For growth investors like me, Usha Martin Education & Solutions's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. Even so, be aware that Usha Martin Education & Solutions is showing 4 warning signs in our investment analysis , and 2 of those are a bit concerning...

Although Usha Martin Education & Solutions certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Usha Martin Education & Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UMESLTD

Usha Martin Education & Solutions

Provides educational services primarily in India.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives