- India

- /

- Consumer Services

- /

- NSEI:TREEHOUSE

If You Had Bought Tree House Education & Accessories (NSE:TREEHOUSE) Stock Five Years Ago, You'd Be Sitting On A 99% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Tree House Education & Accessories Limited (NSE:TREEHOUSE) during the five years that saw its share price drop a whopping 99%. And we doubt long term believers are the only worried holders, since the stock price has declined 31% over the last twelve months. Furthermore, it's down 16% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Tree House Education & Accessories

We don't think Tree House Education & Accessories's revenue of ₹36,600,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Tree House Education & Accessories can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). It certainly is a dangerous place to invest, as Tree House Education & Accessories investors might realise.

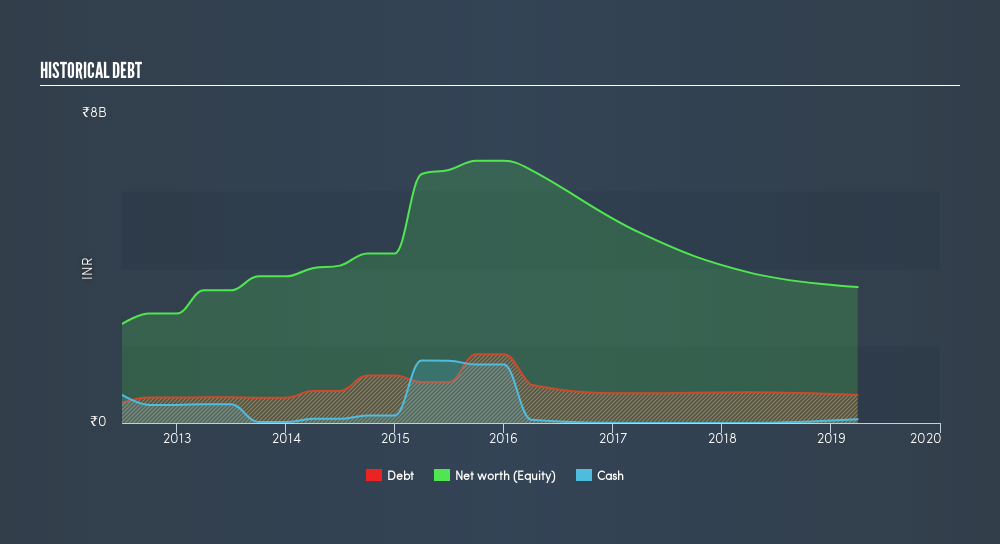

Tree House Education & Accessories had liabilities exceeding cash by ₹844,800,000 when it last reported in March 2019, according to our data. That makes it extremely high risk, in our view. But since the share price has dived -57% per year, over 5 years, it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how Tree House Education & Accessories's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market gained around 0.2% in the last year, Tree House Education & Accessories shareholders lost 31%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 57% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:TREEHOUSE

Tree House Education & Accessories

Provides educational and related services to the K-12 schools in India.

Adequate balance sheet low.

Market Insights

Community Narratives