- India

- /

- Electronic Equipment and Components

- /

- NSEI:SYRMA

Top Indian Growth Stocks With High Insider Ownership For September 2024

Reviewed by Simply Wall St

The Indian market has gained 1.7% recently and is up an impressive 41% over the last 12 months, with earnings forecasted to grow by 17% annually. In this thriving environment, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially leading to stronger performance.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's dive into some prime choices out of the screener.

Aptus Value Housing Finance India (NSEI:APTUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aptus Value Housing Finance India Limited, along with its subsidiary, operates as a housing finance company in India and has a market cap of ₹167.71 billion.

Operations: Aptus Value Housing Finance India Limited generates revenue primarily from providing long-term housing finance, loans against property, and refinance loans totaling ₹10.46 billion.

Insider Ownership: 25.2%

Earnings Growth Forecast: 18% p.a.

Aptus Value Housing Finance India is a growth company with high insider ownership. It has demonstrated strong earnings growth of 26.1% per year over the past five years and is forecasted to grow earnings by 18% annually, outpacing the Indian market. The company's revenue is also expected to grow faster than the market at 19.7% per year. Recent events include a fixed-income offering of ₹1 billion and changes in statutory auditors, indicating active financial management and governance adjustments.

- Delve into the full analysis future growth report here for a deeper understanding of Aptus Value Housing Finance India.

- Our valuation report here indicates Aptus Value Housing Finance India may be overvalued.

Syrma SGS Technology (NSEI:SYRMA)

Simply Wall St Growth Rating: ★★★★★☆

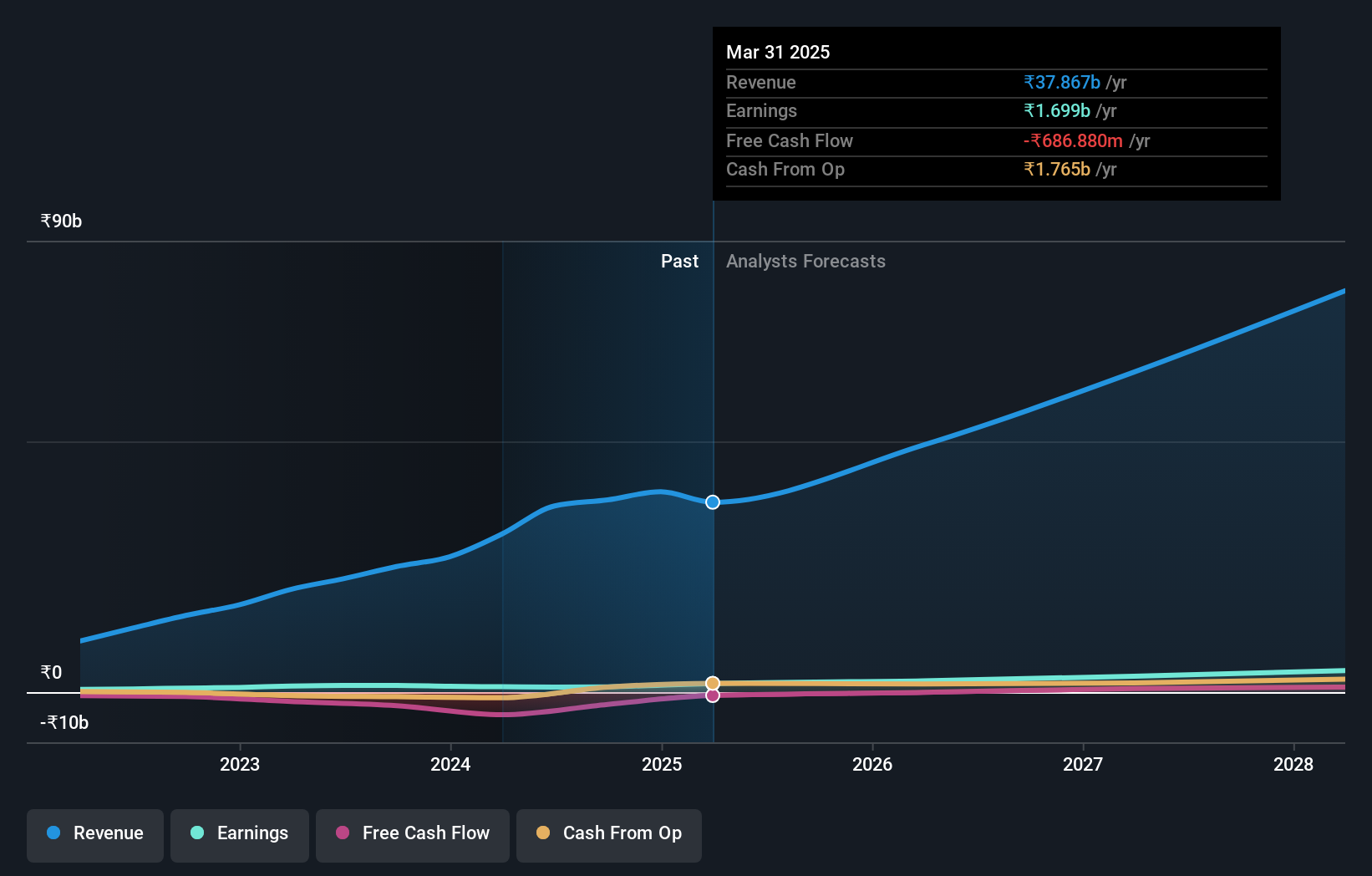

Overview: Syrma SGS Technology Limited offers turnkey electronic manufacturing services across India, the United States, Germany, and internationally with a market cap of ₹83.06 billion.

Operations: The company generates ₹37.12 billion in revenue from its electronic manufacturing services segment.

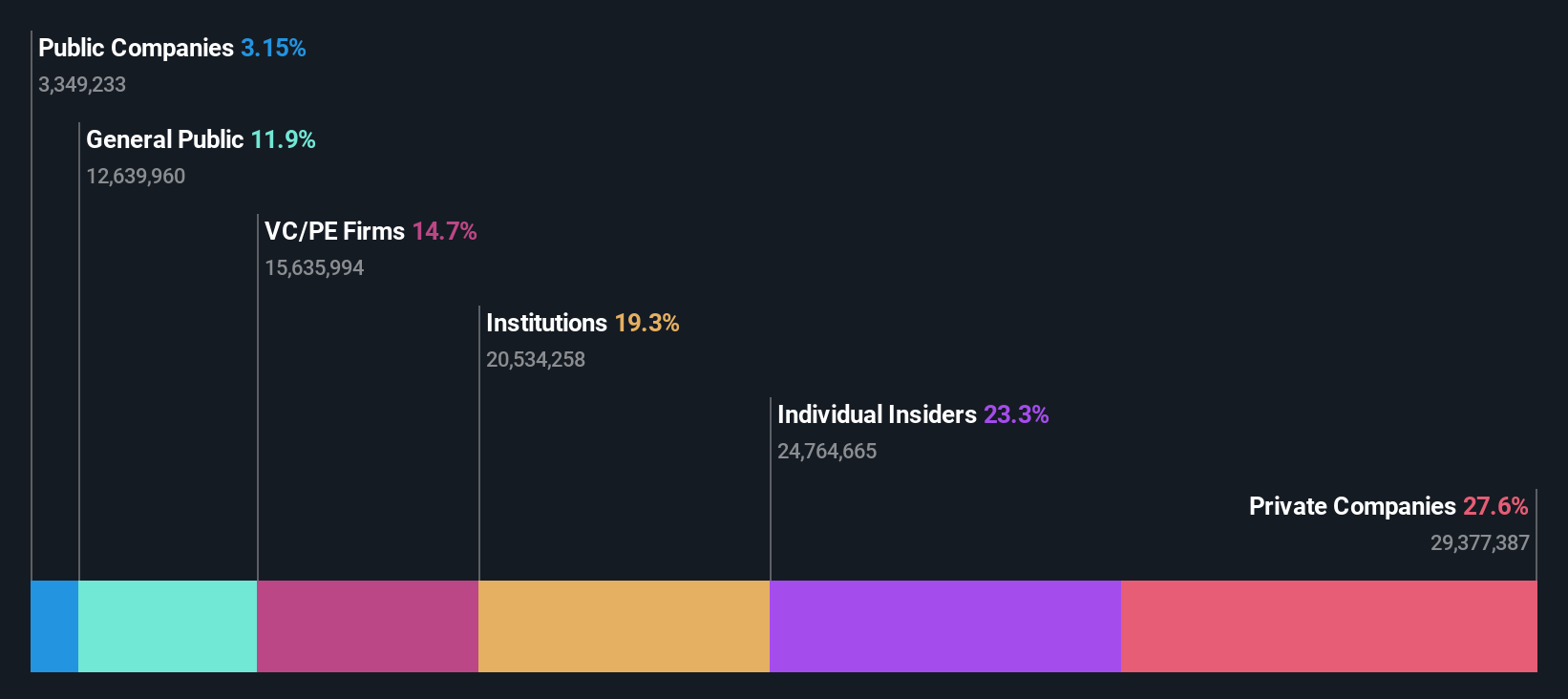

Insider Ownership: 27.8%

Earnings Growth Forecast: 32.7% p.a.

Syrma SGS Technology exhibits strong revenue growth, forecasted at 21.9% annually, outpacing the Indian market's 10.1%. Earnings are expected to grow significantly at 32.7% per year, despite a dip in net profit margins from 5.9% to 2.6%. Recent earnings showed sales of ₹11.60 billion and revenue of ₹11.75 billion for Q1 FY2025, though net income dropped to ₹192.97 million from ₹285.18 million a year ago, with insider ownership remaining high and stable over the past three months.

- Unlock comprehensive insights into our analysis of Syrma SGS Technology stock in this growth report.

- The analysis detailed in our Syrma SGS Technology valuation report hints at an inflated share price compared to its estimated value.

TBO Tek (NSEI:TBOTEK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBO Tek Limited operates travel distribution platforms in India and internationally, with a market cap of ₹190.59 billion.

Operations: The company's revenue segments include Air Ticketing at ₹3.44 billion and Hotels and Packages at ₹10.88 billion.

Insider Ownership: 23.3%

Earnings Growth Forecast: 30.2% p.a.

TBO Tek Limited, a growth company with high insider ownership, reported strong Q1 FY2025 results with sales of ₹4.18 billion and net income of ₹609.19 million. Earnings are forecast to grow at 30.2% annually, outpacing the Indian market's 17.1%. Recent changes include appointing new auditors and amending the Articles of Association during their AGM on August 23, 2024. However, the company received a show cause notice from the GST department for short payment of tax liability in FY2017-18 amounting to ₹8.91 million but stated it would not materially impact operations or finances.

- Dive into the specifics of TBO Tek here with our thorough growth forecast report.

- Our valuation report unveils the possibility TBO Tek's shares may be trading at a premium.

Turning Ideas Into Actions

- Click here to access our complete index of 92 Fast Growing Indian Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SYRMA

Syrma SGS Technology

Provides turnkey electronic manufacturing services in India, the United States, Germany, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives