- India

- /

- Consumer Services

- /

- NSEI:KAYA

Increasing losses over three years doesn't faze Kaya (NSE:KAYA) investors as stock swells 10% this past week

It's nice to see the Kaya Limited (NSE:KAYA) share price up 10% in a week. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 19% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

On a more encouraging note the company has added ₹459m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Kaya

Kaya wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Kaya grew revenue at 8.6% per year. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 6% per year. This implies the market had higher expectations of Kaya. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

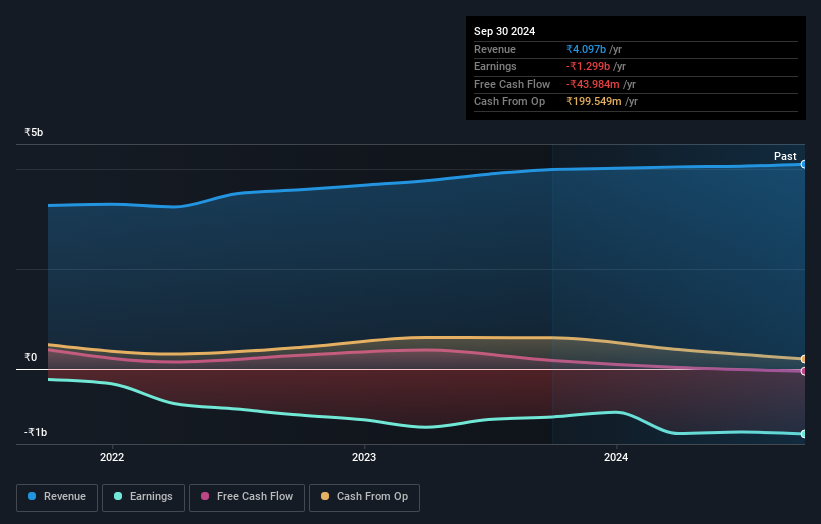

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Kaya shareholders are up 15% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 3% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Kaya (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KAYA

Kaya

Owns and operates skin and hair care clinics in India and the Middle East.

Low and slightly overvalued.