- India

- /

- Hospitality

- /

- NSEI:EASEMYTRIP

Easy Trip Planners Limited (NSE:EASEMYTRIP) Analysts Just Trimmed Their Revenue Forecasts By 12%

Market forces rained on the parade of Easy Trip Planners Limited (NSE:EASEMYTRIP) shareholders today, when the analysts downgraded their forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

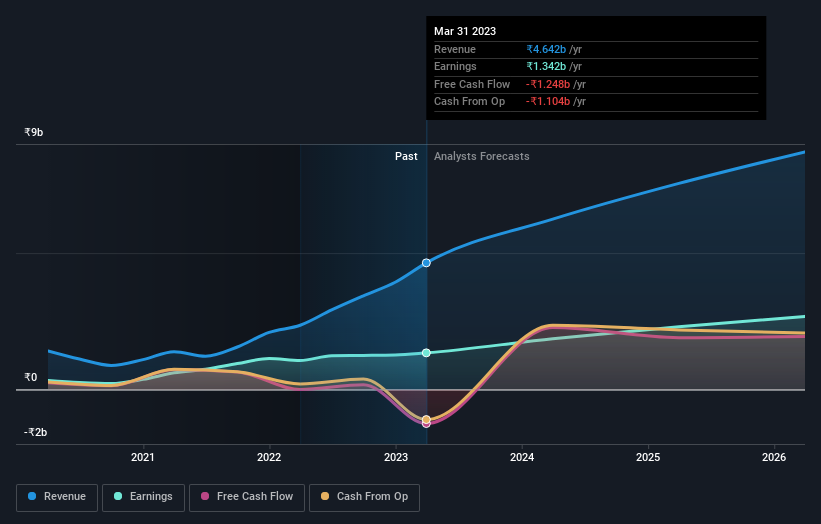

Following the downgrade, the current consensus from Easy Trip Planners' two analysts is for revenues of ₹6.2b in 2024 which - if met - would reflect a major 35% increase on its sales over the past 12 months. Statutory earnings per share are presumed to shoot up 42% to ₹1.10. Before this latest update, the analysts had been forecasting revenues of ₹7.1b and earnings per share (EPS) of ₹1.16 in 2024. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a measurable cut to revenue estimates and a minor downgrade to EPS estimates to boot.

See our latest analysis for Easy Trip Planners

Analysts made no major changes to their price target of ₹56.33, suggesting the downgrades are not expected to have a long-term impact on Easy Trip Planners' valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Easy Trip Planners analyst has a price target of ₹63.00 per share, while the most pessimistic values it at ₹51.00. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Easy Trip Planners is an easy business to forecast or the underlying assumptions are obvious.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 35% growth on an annualised basis. That is in line with its 34% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 14% annually. So although Easy Trip Planners is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Easy Trip Planners. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Easy Trip Planners after today.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Easy Trip Planners' financials, such as concerns around earnings quality. For more information, you can click here to discover this and the 1 other flag we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Easy Trip Planners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EASEMYTRIP

Easy Trip Planners

Operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, Brazil, the Middle East, and the United States.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026