- India

- /

- Consumer Services

- /

- NSEI:COMPUSOFT

Do Compucom Software's (NSE:COMPUSOFT) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Compucom Software (NSE:COMPUSOFT), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Compucom Software

How Fast Is Compucom Software Growing Its Earnings Per Share?

Over the last three years, Compucom Software has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Compucom Software's EPS skyrocketed from ₹0.57 to ₹0.96, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 67%.

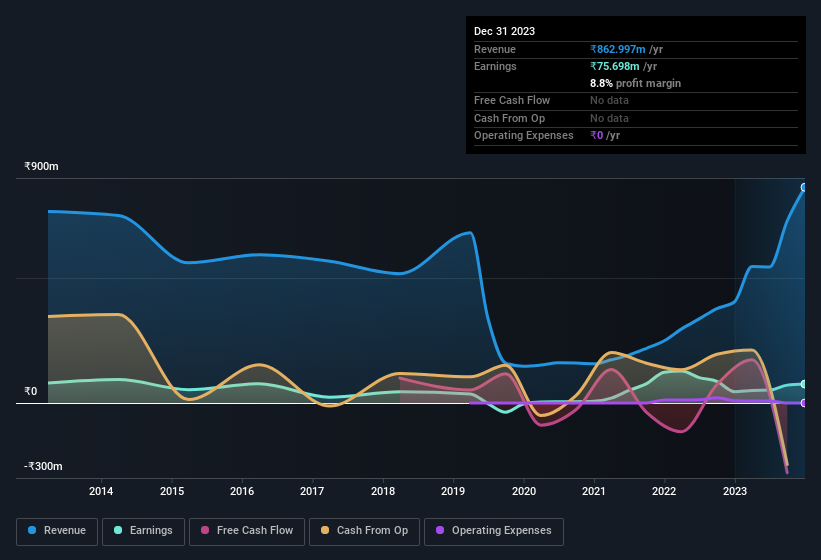

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Compucom Software did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Compucom Software isn't a huge company, given its market capitalisation of ₹2.1b. That makes it extra important to check on its balance sheet strength.

Are Compucom Software Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Compucom Software, with market caps under ₹17b is around ₹3.3m.

The Compucom Software CEO received total compensation of only ₹2.7m in the year to March 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Compucom Software Worth Keeping An Eye On?

For growth investors, Compucom Software's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. Before you take the next step you should know about the 2 warning signs for Compucom Software that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COMPUSOFT

Compucom Software

Together with its subsidiary, CSL Infomedia Private Limited, operates as a software and education company in India and the United States.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives