- India

- /

- Consumer Services

- /

- NSEI:CPCAP

Returns On Capital At Career Point (NSE:CAREERP) Have Hit The Brakes

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think Career Point (NSE:CAREERP) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Career Point is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.057 = ₹324m ÷ (₹5.9b - ₹229m) (Based on the trailing twelve months to December 2023).

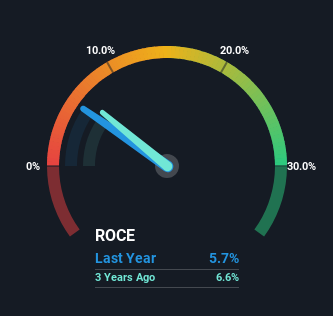

Therefore, Career Point has an ROCE of 5.7%. Ultimately, that's a low return and it under-performs the Consumer Services industry average of 9.1%.

Check out our latest analysis for Career Point

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Career Point has performed in the past in other metrics, you can view this free graph of Career Point's past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

There are better returns on capital out there than what we're seeing at Career Point. The company has consistently earned 5.7% for the last five years, and the capital employed within the business has risen 25% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

In Conclusion...

Long story short, while Career Point has been reinvesting its capital, the returns that it's generating haven't increased. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 517% gain to shareholders who have held over the last five years. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

One final note, you should learn about the 4 warning signs we've spotted with Career Point (including 1 which can't be ignored) .

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CPCAP

CP Capital

A non-banking financing company, provides financing support to educational institutions for developing educational infrastructure.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives