- India

- /

- Hospitality

- /

- NSEI:BARBEQUE

Barbeque-Nation Hospitality Limited's (NSE:BARBEQUE) Shares Lagging The Industry But So Is The Business

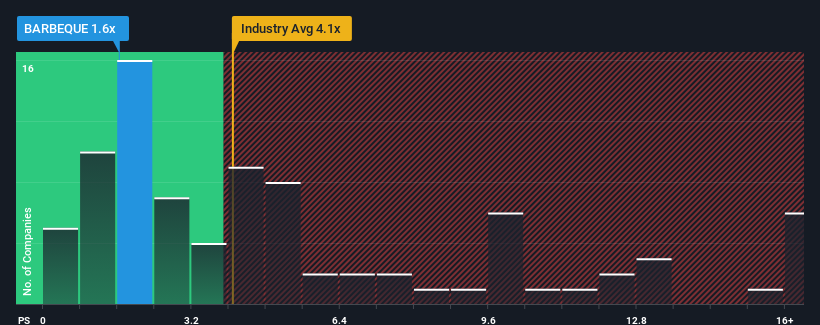

Barbeque-Nation Hospitality Limited's (NSE:BARBEQUE) price-to-sales (or "P/S") ratio of 1.6x might make it look like a strong buy right now compared to the Hospitality industry in India, where around half of the companies have P/S ratios above 4.1x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Barbeque-Nation Hospitality

How Has Barbeque-Nation Hospitality Performed Recently?

Recent times haven't been great for Barbeque-Nation Hospitality as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Barbeque-Nation Hospitality.How Is Barbeque-Nation Hospitality's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Barbeque-Nation Hospitality's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. The latest three year period has also seen an excellent 151% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% over the next year. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

With this information, we can see why Barbeque-Nation Hospitality is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Barbeque-Nation Hospitality's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Barbeque-Nation Hospitality with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Barbeque-Nation Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BARBEQUE

Barbeque-Nation Hospitality

Owns and operates a chain of casual dining restaurants under the Barbeque-Nation brand name in India, the United Arab Emirates, Oman, Malaysia, and Bahrain.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives