- India

- /

- Hospitality

- /

- NSEI:BARBEQUE

Barbeque-Nation Hospitality Limited (NSE:BARBEQUE) Stock Catapults 27% Though Its Price And Business Still Lag The Industry

Barbeque-Nation Hospitality Limited (NSE:BARBEQUE) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

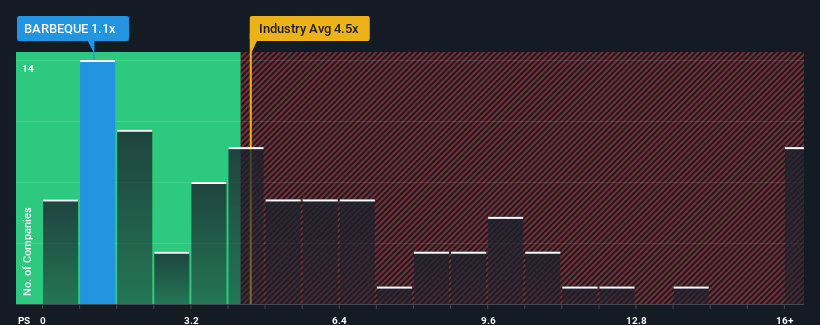

In spite of the firm bounce in price, Barbeque-Nation Hospitality may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Hospitality industry in India have P/S ratios greater than 4.5x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Barbeque-Nation Hospitality

What Does Barbeque-Nation Hospitality's P/S Mean For Shareholders?

Recent times haven't been great for Barbeque-Nation Hospitality as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Barbeque-Nation Hospitality's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Barbeque-Nation Hospitality's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 48% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 35% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Barbeque-Nation Hospitality's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Barbeque-Nation Hospitality's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Barbeque-Nation Hospitality's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Barbeque-Nation Hospitality with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Barbeque-Nation Hospitality, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barbeque-Nation Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BARBEQUE

Barbeque-Nation Hospitality

Owns and operates a chain of casual dining restaurants under the Barbeque-Nation brand name in India, the United Arab Emirates, Oman, Malaysia, and Bahrain.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives