- India

- /

- Food and Staples Retail

- /

- NSEI:AKG

These 4 Measures Indicate That AKG Exim (NSE:AKG) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies AKG Exim Limited (NSE:AKG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for AKG Exim

What Is AKG Exim's Net Debt?

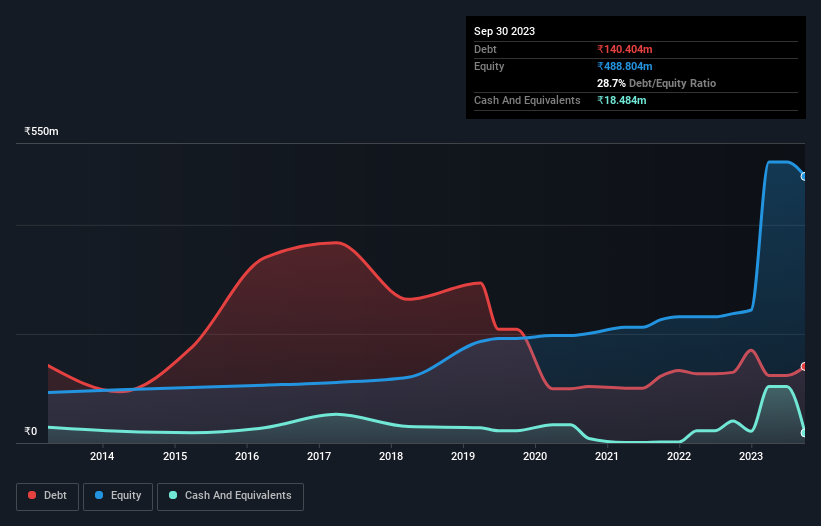

As you can see below, at the end of September 2023, AKG Exim had ₹140.4m of debt, up from ₹129.5m a year ago. Click the image for more detail. However, because it has a cash reserve of ₹18.5m, its net debt is less, at about ₹121.9m.

How Healthy Is AKG Exim's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that AKG Exim had liabilities of ₹25.6m due within 12 months and liabilities of ₹5.37m due beyond that. Offsetting these obligations, it had cash of ₹18.5m as well as receivables valued at ₹407.7m due within 12 months. So it actually has ₹395.2m more liquid assets than total liabilities.

This surplus liquidity suggests that AKG Exim's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While AKG Exim's debt to EBITDA ratio (3.7) suggests that it uses some debt, its interest cover is very weak, at 2.4, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. On a lighter note, we note that AKG Exim grew its EBIT by 24% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. There's no doubt that we learn most about debt from the balance sheet. But it is AKG Exim's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, AKG Exim burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

AKG Exim's level of total liabilities suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Looking at all the aforementioned factors together, it strikes us that AKG Exim can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with AKG Exim .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AKG

Excellent balance sheet with questionable track record.