- India

- /

- Food and Staples Retail

- /

- NSEI:AKG

Should You Be Adding AKG Exim (NSE:AKG) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like AKG Exim (NSE:AKG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for AKG Exim

How Quickly Is AKG Exim Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. AKG Exim managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

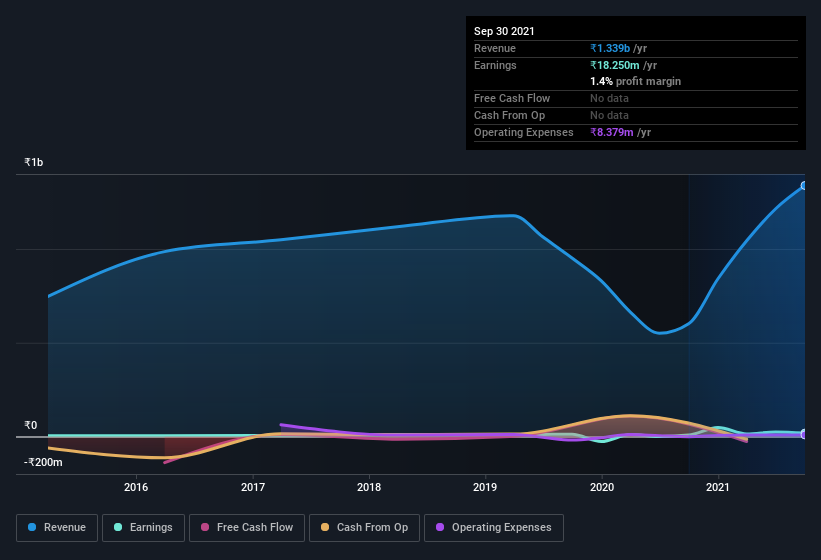

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. AKG Exim shareholders can take confidence from the fact that EBIT margins are up from -0.8% to 2.6%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since AKG Exim is no giant, with a market capitalization of ₹525m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are AKG Exim Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that AKG Exim insiders own a significant number of shares certainly appeals to me. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, AKG Exim is a very small company, with a market cap of only ₹525m. So despite a large proportional holding, insiders only have ₹356m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like AKG Exim with market caps under ₹15b is about ₹2.8m.

The AKG Exim CEO received total compensation of only ₹1.4m in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does AKG Exim Deserve A Spot On Your Watchlist?

One important encouraging feature of AKG Exim is that it is growing profits. The fact that EPS is growing is a genuine positive for AKG Exim, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Before you take the next step you should know about the 3 warning signs for AKG Exim (2 are a bit concerning!) that we have uncovered.

Although AKG Exim certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AKG

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives