Introducing Vera Synthetic (NSE:VERA), The Stock That Dropped 22% In The Last Year

Vera Synthetic Limited (NSE:VERA) shareholders should be happy to see the share price up 13% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 22% in the last year, well below the market return.

See our latest analysis for Vera Synthetic

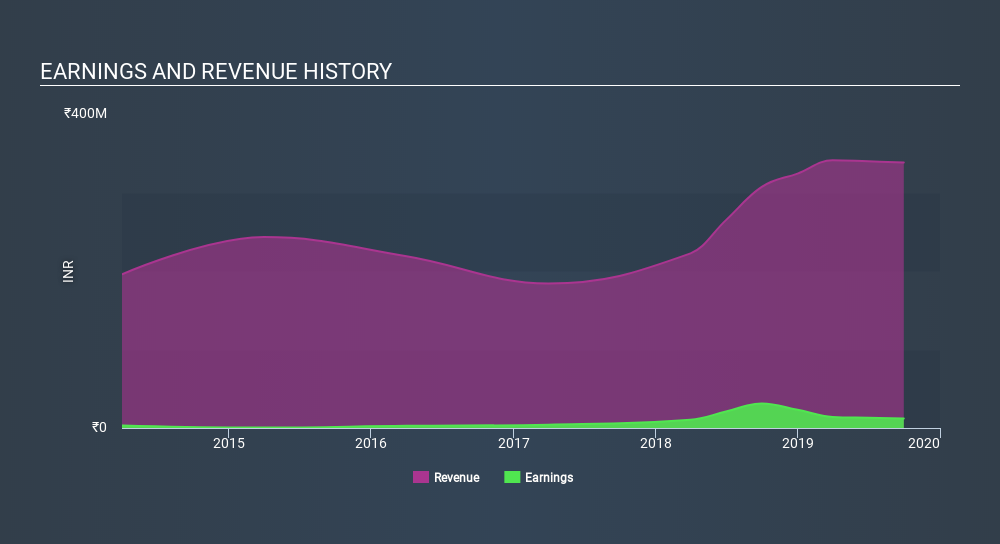

We don't think that Vera Synthetic's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Vera Synthetic saw its revenue grow by 10%. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 22% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Vera Synthetic's financial health with this free report on its balance sheet.

A Different Perspective

We doubt Vera Synthetic shareholders are happy with the loss of 22% over twelve months. That falls short of the market, which lost 13%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's worth noting that the last three months did the real damage, with a 29% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Vera Synthetic better, we need to consider many other factors. For example, we've discovered 5 warning signs for Vera Synthetic (2 can't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:VERA

Vera Synthetic

Engages in the manufacture and sale of fishing nets and ropes in India and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives