Swan Energy Limited's (NSE:SWANENERGY) P/S Is Still On The Mark Following 25% Share Price Bounce

Swan Energy Limited (NSE:SWANENERGY) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The annual gain comes to 235% following the latest surge, making investors sit up and take notice.

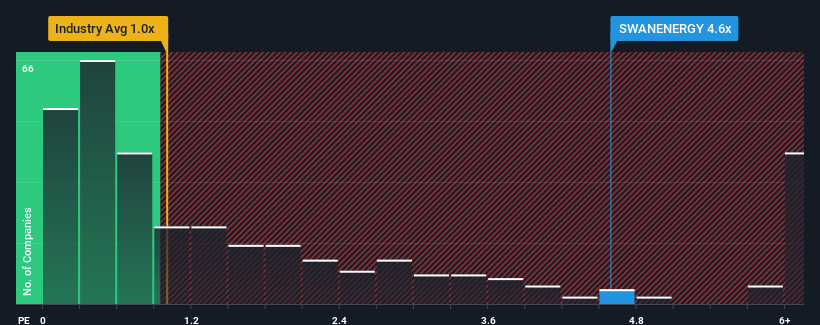

Following the firm bounce in price, when almost half of the companies in India's Luxury industry have price-to-sales ratios (or "P/S") below 1x, you may consider Swan Energy as a stock not worth researching with its 4.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Swan Energy

How Swan Energy Has Been Performing

Swan Energy certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Swan Energy's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Swan Energy?

Swan Energy's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 249%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Swan Energy is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Swan Energy's P/S?

Shares in Swan Energy have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Swan Energy can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Swan Energy.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SWANCORP

Swan

Manufactures and markets cotton, polyester cotton, linen and viscose fabrics, and non-lycra products in India and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives