Suryalakshmi Cotton Mills Limited's (NSE:SURYALAXMI) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Suryalakshmi Cotton Mills Limited (NSE:SURYALAXMI) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

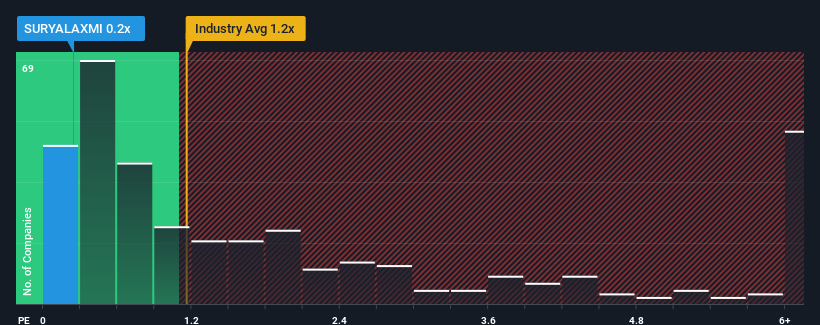

Although its price has surged higher, given about half the companies operating in India's Luxury industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Suryalakshmi Cotton Mills as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Suryalakshmi Cotton Mills

What Does Suryalakshmi Cotton Mills' P/S Mean For Shareholders?

For example, consider that Suryalakshmi Cotton Mills' financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Suryalakshmi Cotton Mills will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Suryalakshmi Cotton Mills?

Suryalakshmi Cotton Mills' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 23% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Suryalakshmi Cotton Mills' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Suryalakshmi Cotton Mills' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Suryalakshmi Cotton Mills' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Suryalakshmi Cotton Mills confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 4 warning signs for Suryalakshmi Cotton Mills (1 is significant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Suryalakshmi Cotton Mills, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SURYALAXMI

Suryalakshmi Cotton Mills

Engages in the manufacture and sale of cotton and blended yarns, denim fabrics, and garments in India, Bangladesh, Ethiopia, Guatemala, Kenya, Mauritius, Madagascar, South Korea, and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives