For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term S.P. Apparels Limited (NSE:SPAL) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 21%. The more recent news is of little comfort, with the share price down 37% in a year. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days.

Check out our latest analysis for S.P. Apparels

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, S.P. Apparels actually managed to grow EPS by 5.1% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

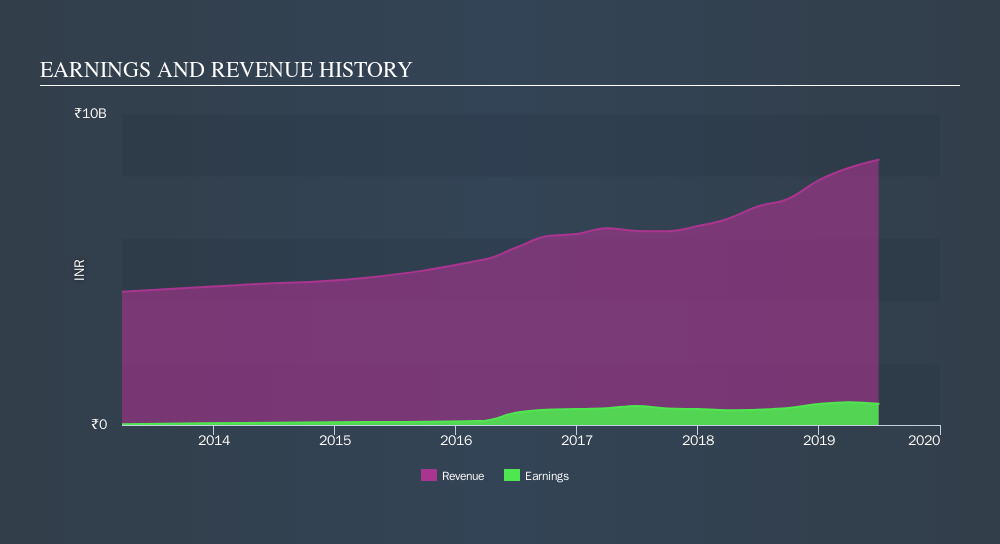

We note that, in three years, revenue has actually grown at a 13% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching S.P. Apparels more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how revenue has tracked over time.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for S.P. Apparels in this interactive graph of future profit estimates.

A Different Perspective

The last twelve months weren't great for S.P. Apparels shares, which performed worse than the market, costing holders 37%. Meanwhile, the broader market slid about 4.3%, likely weighing on the stock. Shareholders have lost 19% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SPAL

S.P. Apparels

Engages in manufacturing and exporting of knitted garments for infants and children in India and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives