We Think Some Shareholders May Hesitate To Increase Sarla Performance Fibers Limited's (NSE:SARLAPOLY) CEO Compensation

Key Insights

- Sarla Performance Fibers will host its Annual General Meeting on 21st of September

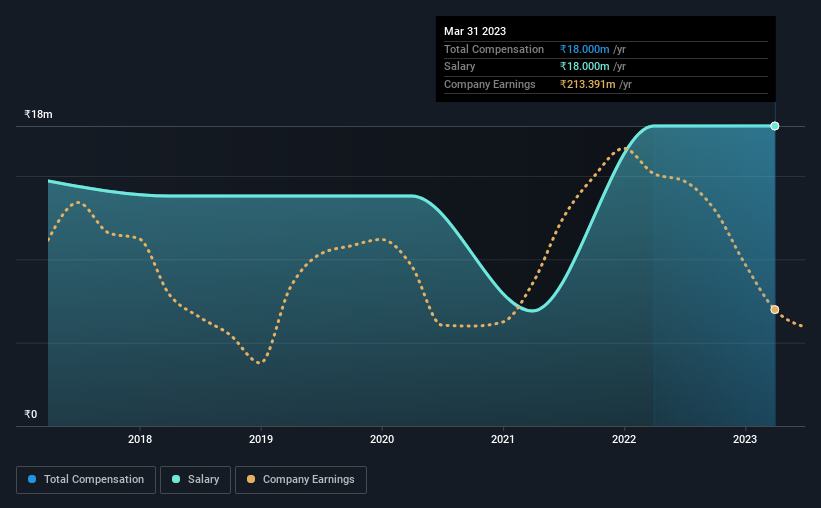

- Total pay for CEO Krishnakumar Jhunjhunwala includes ₹18.0m salary

- Total compensation is 361% above industry average

- Sarla Performance Fibers' total shareholder return over the past three years was 144% while its EPS grew by 0.01% over the past three years

Performance at Sarla Performance Fibers Limited (NSE:SARLAPOLY) has been reasonably good and CEO Krishnakumar Jhunjhunwala has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 21st of September. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Sarla Performance Fibers

How Does Total Compensation For Krishnakumar Jhunjhunwala Compare With Other Companies In The Industry?

At the time of writing, our data shows that Sarla Performance Fibers Limited has a market capitalization of ₹4.4b, and reported total annual CEO compensation of ₹18m for the year to March 2023. This was the same amount the CEO received in the prior year. Notably, the salary of ₹18m is the entirety of the CEO compensation.

On comparing similar-sized companies in the Indian Luxury industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹3.9m. Accordingly, our analysis reveals that Sarla Performance Fibers Limited pays Krishnakumar Jhunjhunwala north of the industry median. Moreover, Krishnakumar Jhunjhunwala also holds ₹252m worth of Sarla Performance Fibers stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹18m | ₹18m | 100% |

| Other | - | - | - |

| Total Compensation | ₹18m | ₹18m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Speaking on a company level, Sarla Performance Fibers prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Sarla Performance Fibers Limited's Growth Numbers

Over the last three years, Sarla Performance Fibers Limited has not seen its earnings per share change much, though there is a slight positive movement. In the last year, its revenue is down 23%.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Sarla Performance Fibers Limited Been A Good Investment?

Boasting a total shareholder return of 144% over three years, Sarla Performance Fibers Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Sarla Performance Fibers rewards its CEO solely through a salary, ignoring non-salary benefits completely. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Sarla Performance Fibers that investors should look into moving forward.

Important note: Sarla Performance Fibers is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SARLAPOLY

Sarla Performance Fibers

Manufactures and sells yarns in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives