- India

- /

- Consumer Durables

- /

- NSEI:PULZ

Pulz Electronics Limited's (NSE:PULZ) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Pulz Electronics Limited (NSE:PULZ) shares have continued their recent momentum with a 31% gain in the last month alone. The annual gain comes to 245% following the latest surge, making investors sit up and take notice.

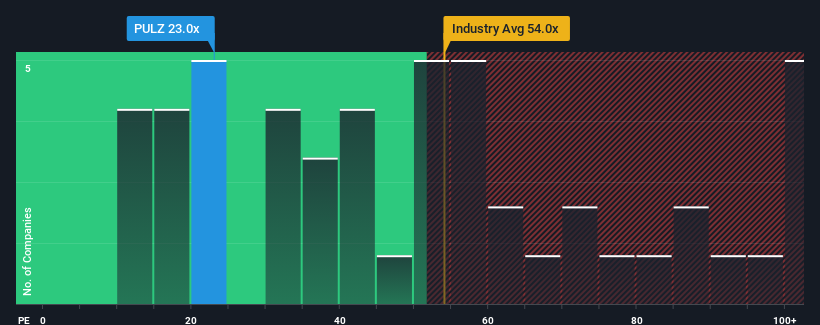

Although its price has surged higher, Pulz Electronics may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23x, since almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 60x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, Pulz Electronics has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Pulz Electronics

How Is Pulz Electronics' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Pulz Electronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 92%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Pulz Electronics is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Pulz Electronics' P/E?

Despite Pulz Electronics' shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Pulz Electronics maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Pulz Electronics is showing 4 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If you're unsure about the strength of Pulz Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PULZ

Pulz Electronics

Engages in the development, manufacture, and sale of audio systems in India, South East Asia, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.