- India

- /

- Consumer Durables

- /

- NSEI:PRITI

Should You Be Adding Priti International (NSE:PRITI) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Priti International (NSE:PRITI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Priti International with the means to add long-term value to shareholders.

Check out our latest analysis for Priti International

How Fast Is Priti International Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Priti International has managed to grow EPS by 29% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

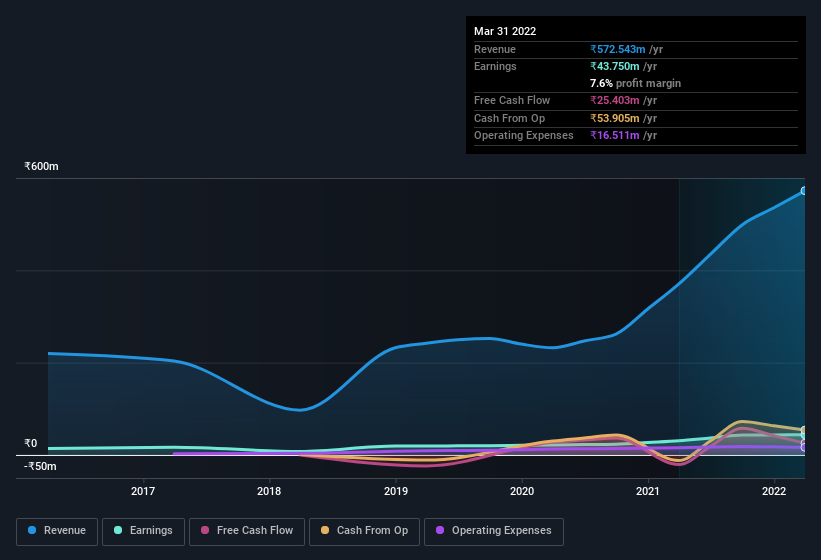

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Priti International's EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Priti International is no giant, with a market capitalisation of ₹1.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Priti International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Priti International insiders refrain from selling stock during the year, but they also spent ₹11m buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Chairman & Vigil Mechanism Officer Goverdhan Lohiya for ₹4.5m worth of shares, at about ₹70.16 per share.

On top of the insider buying, we can also see that Priti International insiders own a large chunk of the company. Indeed, with a collective holding of 96%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹1.5b at the current share price. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Priti International's CEO, Priti Lohiya, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Priti International with market caps under ₹16b is about ₹3.0m.

The Priti International CEO received total compensation of only ₹1.7m in the year to March 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Priti International Worth Keeping An Eye On?

For growth investors, Priti International's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. However, before you get too excited we've discovered 2 warning signs for Priti International (1 shouldn't be ignored!) that you should be aware of.

The good news is that Priti International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRITI

Priti International

Engages in the manufacture, sale, and export of wooden, metal, and textile based furniture and handicraft products in India.

Excellent balance sheet with low risk.

Market Insights

Community Narratives