Indian Stocks That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.6% decline, yet it remains up by an impressive 40% over the past year, with earnings anticipated to grow by 17% annually in the coming years. In such a fluctuating environment, identifying stocks that may be trading below their estimated fair value can offer potential opportunities for investors seeking to capitalize on long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹188.79 | ₹306.16 | 38.3% |

| Apollo Pipes (BSE:531761) | ₹574.25 | ₹1137.14 | 49.5% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1120.15 | ₹2151.07 | 47.9% |

| RITES (NSEI:RITES) | ₹317.25 | ₹517.81 | 38.7% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹452.40 | ₹762.32 | 40.7% |

| Vedanta (NSEI:VEDL) | ₹508.70 | ₹931.52 | 45.4% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1284.05 | ₹2142.32 | 40.1% |

| Patel Engineering (BSE:531120) | ₹55.71 | ₹92.42 | 39.7% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹267.80 | ₹445.15 | 39.8% |

| Strides Pharma Science (NSEI:STAR) | ₹1457.90 | ₹2704.30 | 46.1% |

Here's a peek at a few of the choices from the screener.

Archean Chemical Industries (NSEI:ACI)

Overview: Archean Chemical Industries Limited manufactures and sells specialty marine chemicals in India and internationally, with a market cap of ₹86.89 billion.

Operations: The company's revenue is primarily derived from its Marine Chemicals segment, amounting to ₹11.99 billion.

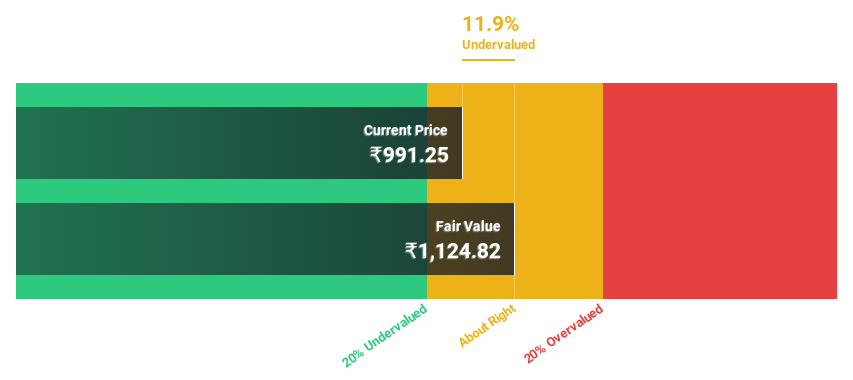

Estimated Discount To Fair Value: 10.8%

Archean Chemical Industries is trading at ₹704.15, below its estimated fair value of ₹789.66, offering good relative value compared to peers. Despite recent regulatory penalties totaling over ₹7 million and a drop in Q1 earnings to INR 448.57 million from the previous year, the company shows promising growth prospects with forecasted annual revenue and earnings growth rates of 28.4% and 34.2%, respectively, surpassing market averages.

- The analysis detailed in our Archean Chemical Industries growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Archean Chemical Industries stock in this financial health report.

Everest Kanto Cylinder (NSEI:EKC)

Overview: Everest Kanto Cylinder Limited, along with its subsidiaries, manufactures and sells gas cylinders in India, with a market cap of ₹21.18 billion.

Operations: The company's revenue is primarily derived from the manufacturing and sale of gas cylinders in India.

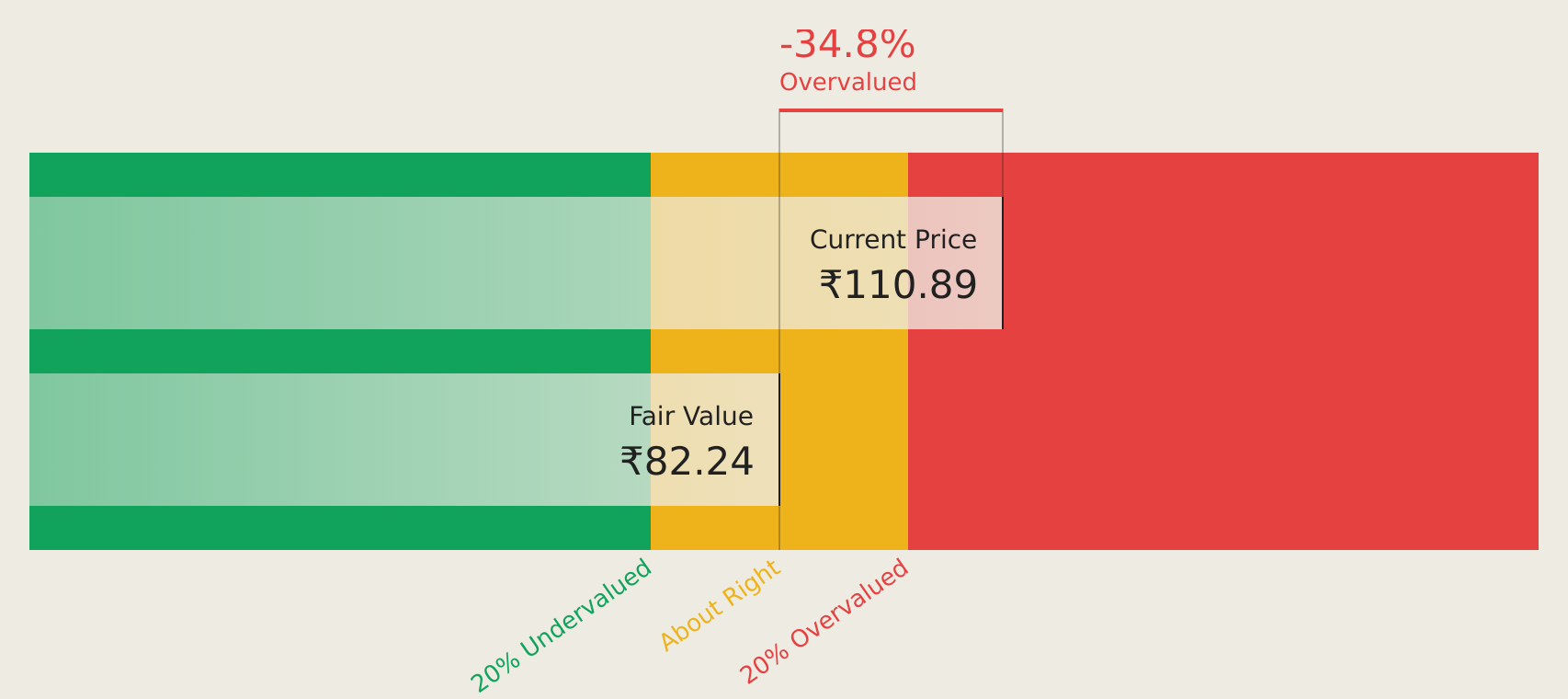

Estimated Discount To Fair Value: 38.3%

Everest Kanto Cylinder, trading at ₹188.79, is significantly undervalued against its estimated fair value of ₹306.16, presenting a compelling opportunity based on cash flow analysis. Despite a volatile share price and an unstable dividend history, the company's recent earnings report shows strong performance with net income rising to INR 280.5 million for Q1 2024 from INR 217.5 million the previous year. Forecasts indicate robust annual profit growth of 27.51%, outpacing market averages.

- In light of our recent growth report, it seems possible that Everest Kanto Cylinder's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Everest Kanto Cylinder.

Pearl Global Industries (NSEI:PGIL)

Overview: Pearl Global Industries Limited, with a market cap of ₹42.38 billion, manufactures and exports readymade garments both in India and internationally through its subsidiaries.

Operations: Revenue Segments (in millions of ₹): The company generates revenue primarily through the manufacturing and export of readymade garments.

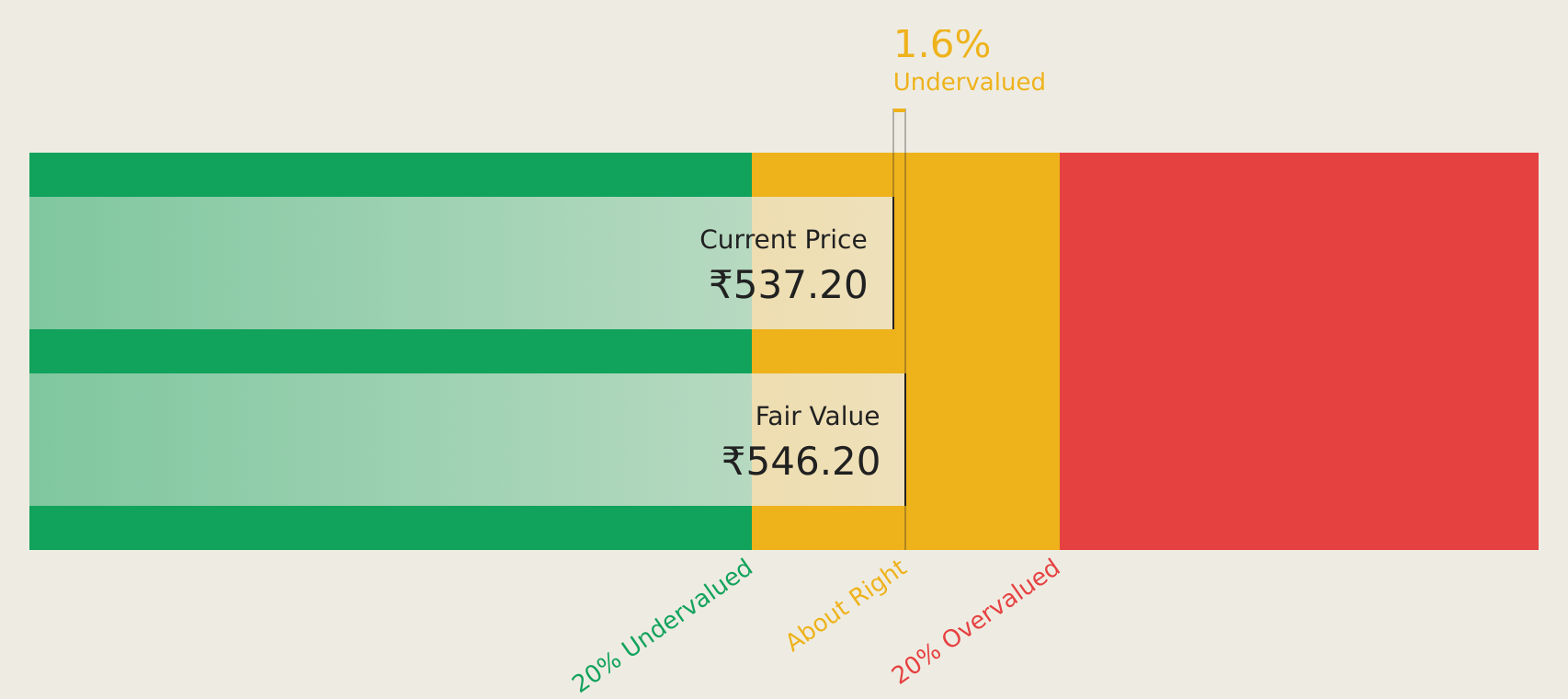

Estimated Discount To Fair Value: 17.3%

Pearl Global Industries, trading at ₹924.2, is undervalued compared to its fair value estimate of ₹1117.87. The company reported robust Q1 2024 earnings with net income rising to INR 653.49 million from INR 480.57 million a year earlier, despite recent operational disruptions in Bangladesh due to unrest. With projected earnings growth of 28.6% annually—surpassing market averages—and inclusion in the S&P Global BMI Index, it presents a strong case for cash flow-based valuation consideration.

- The growth report we've compiled suggests that Pearl Global Industries' future prospects could be on the up.

- Click here to discover the nuances of Pearl Global Industries with our detailed financial health report.

Key Takeaways

- Dive into all 28 of the Undervalued Indian Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PGIL

Pearl Global Industries

Manufactures and sells readymade garments in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives