The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Pasupati Acrylon Limited (NSE:PASUPTAC) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Pasupati Acrylon's Net Debt?

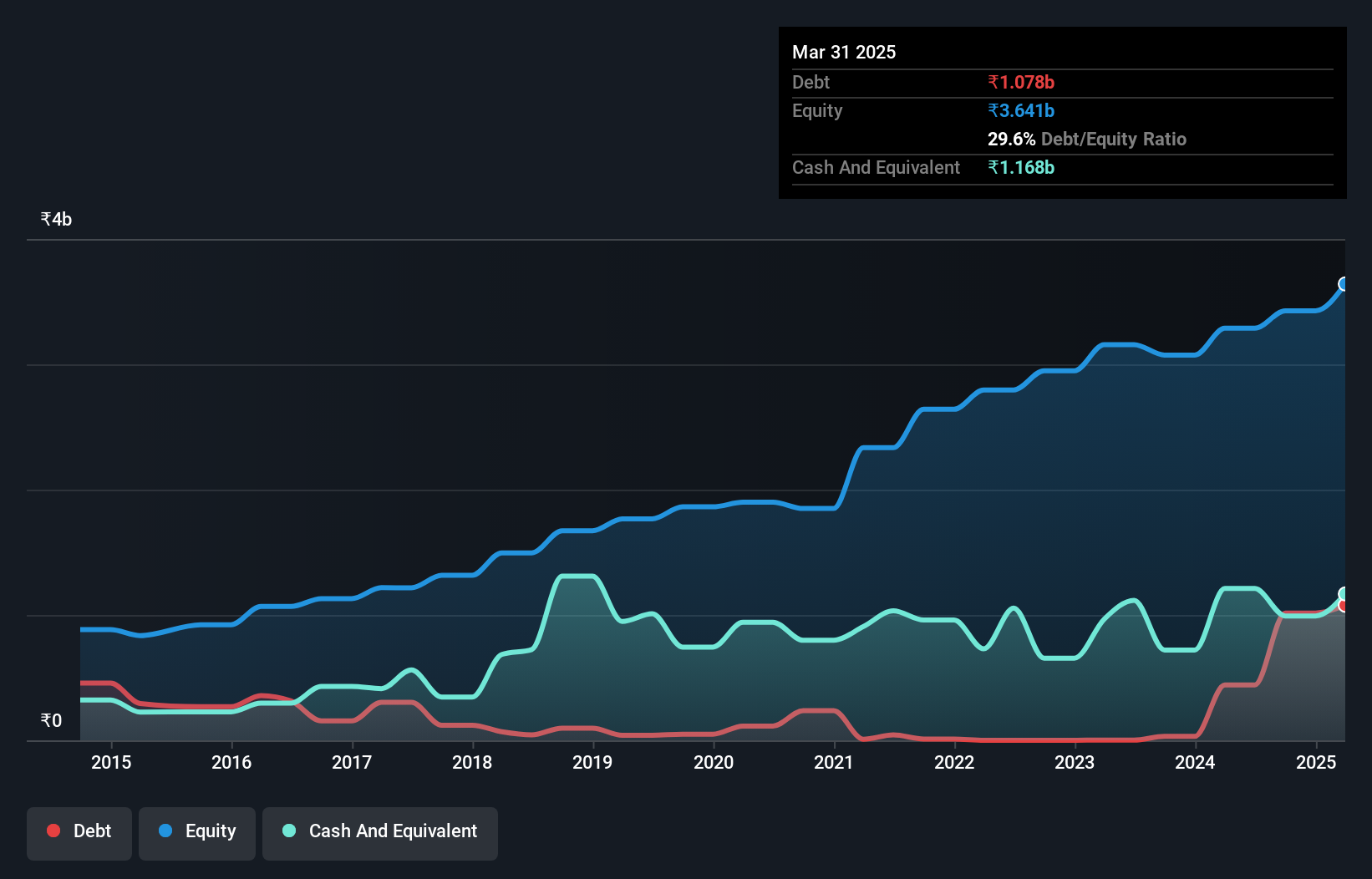

The image below, which you can click on for greater detail, shows that at March 2025 Pasupati Acrylon had debt of ₹1.08b, up from ₹442.3m in one year. But on the other hand it also has ₹1.17b in cash, leading to a ₹90.3m net cash position.

How Strong Is Pasupati Acrylon's Balance Sheet?

The latest balance sheet data shows that Pasupati Acrylon had liabilities of ₹1.09b due within a year, and liabilities of ₹1.22b falling due after that. Offsetting this, it had ₹1.17b in cash and ₹497.8m in receivables that were due within 12 months. So it has liabilities totalling ₹646.7m more than its cash and near-term receivables, combined.

Of course, Pasupati Acrylon has a market capitalization of ₹3.75b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Pasupati Acrylon also has more cash than debt, so we're pretty confident it can manage its debt safely.

View our latest analysis for Pasupati Acrylon

One way Pasupati Acrylon could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Pasupati Acrylon will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Pasupati Acrylon may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Pasupati Acrylon saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While Pasupati Acrylon does have more liabilities than liquid assets, it also has net cash of ₹90.3m. And it impressed us with its EBIT growth of 18% over the last year. So we are not troubled with Pasupati Acrylon's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Pasupati Acrylon that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PASUPTAC

Pasupati Acrylon

Manufactures and sells acrylic fibers, cast polypropylene (CPP) films in India.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.