We Think Some Shareholders May Hesitate To Increase Nitin Spinners Limited's (NSE:NITINSPIN) CEO Compensation

Key Insights

- Nitin Spinners' Annual General Meeting to take place on 6th of September

- CEO Dinesh Nolkha's total compensation includes salary of ₹6.30m

- Total compensation is 62% above industry average

- Nitin Spinners' total shareholder return over the past three years was 63% while its EPS was down 19% over the past three years

Nitin Spinners Limited (NSE:NITINSPIN) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 6th of September. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for Nitin Spinners

Comparing Nitin Spinners Limited's CEO Compensation With The Industry

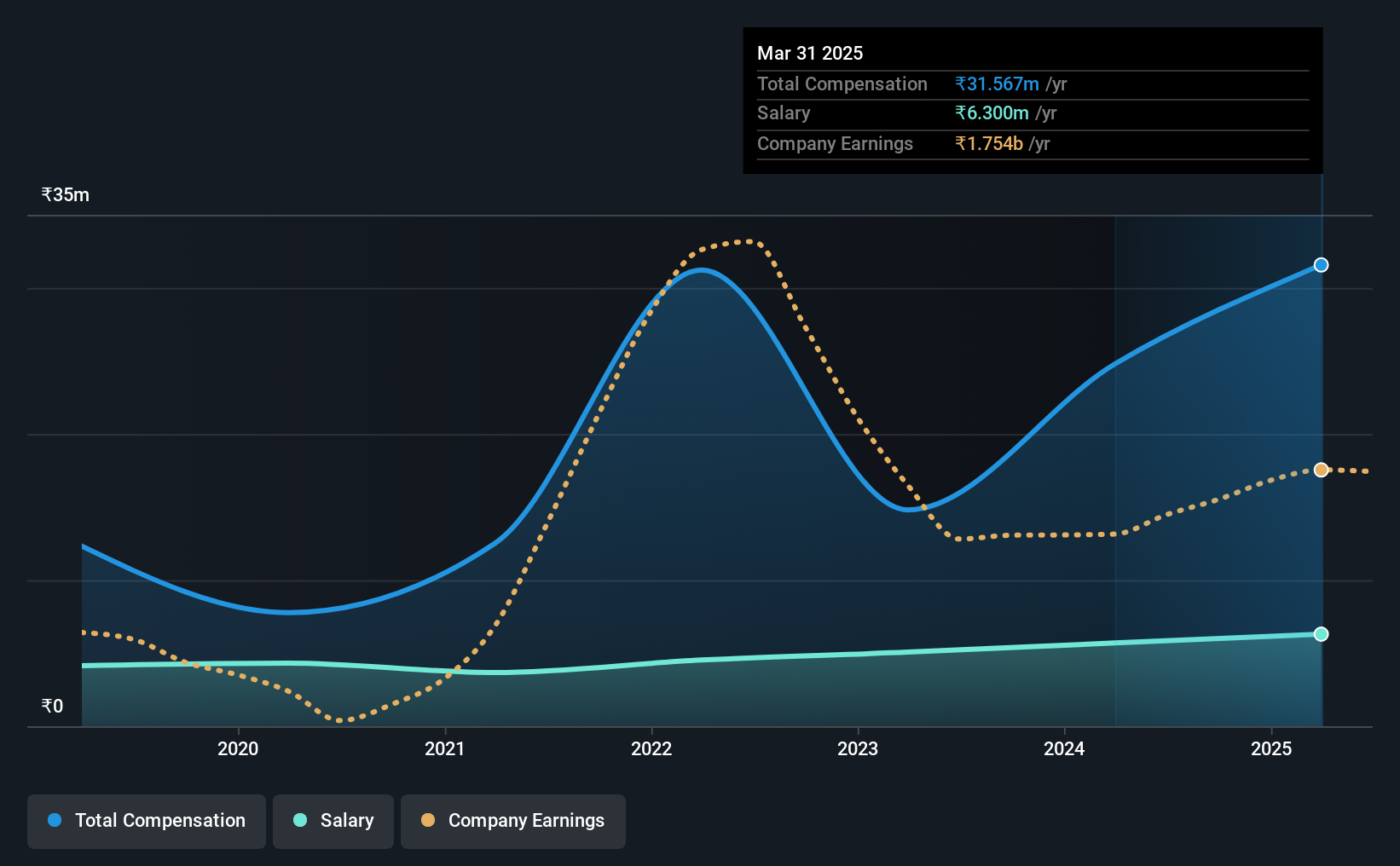

At the time of writing, our data shows that Nitin Spinners Limited has a market capitalization of ₹20b, and reported total annual CEO compensation of ₹32m for the year to March 2025. Notably, that's an increase of 27% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at ₹6.3m.

For comparison, other companies in the Indian Luxury industry with market capitalizations ranging between ₹8.8b and ₹35b had a median total CEO compensation of ₹19m. Accordingly, our analysis reveals that Nitin Spinners Limited pays Dinesh Nolkha north of the industry median. Furthermore, Dinesh Nolkha directly owns ₹540m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹6.3m | ₹5.7m | 20% |

| Other | ₹25m | ₹19m | 80% |

| Total Compensation | ₹32m | ₹25m | 100% |

Speaking on an industry level, nearly 98% of total compensation represents salary, while the remainder of 2% is other remuneration. In Nitin Spinners' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Nitin Spinners Limited's Growth

Nitin Spinners Limited has reduced its earnings per share by 19% a year over the last three years. It achieved revenue growth of 6.6% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Nitin Spinners Limited Been A Good Investment?

We think that the total shareholder return of 63%, over three years, would leave most Nitin Spinners Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Nitin Spinners that investors should think about before committing capital to this stock.

Switching gears from Nitin Spinners, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nitin Spinners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NITINSPIN

Nitin Spinners

Manufactures and sells cotton and blended yarns, knitted fabrics, and finished woven fabrics in India and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion