Nitin Spinners (NSE:NITINSPIN) Use Of Debt Could Be Considered Risky

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Nitin Spinners Limited (NSE:NITINSPIN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nitin Spinners

How Much Debt Does Nitin Spinners Carry?

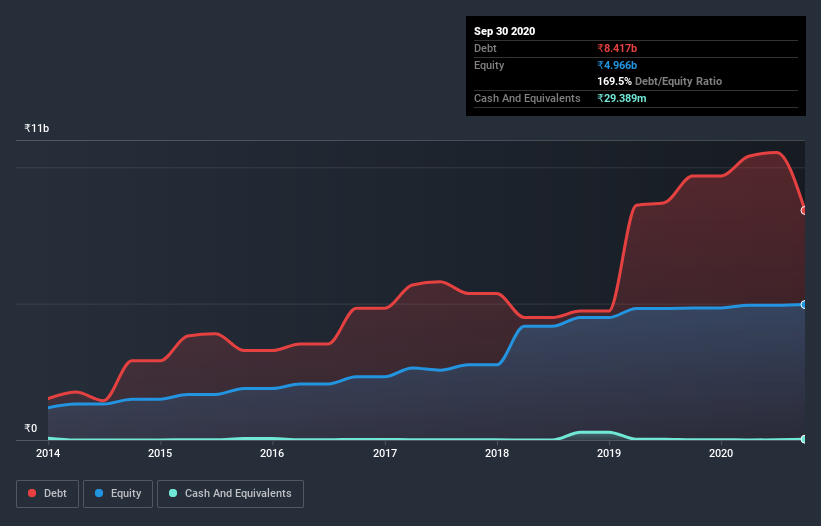

You can click the graphic below for the historical numbers, but it shows that Nitin Spinners had ₹8.42b of debt in September 2020, down from ₹9.68b, one year before. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Nitin Spinners's Balance Sheet?

According to the last reported balance sheet, Nitin Spinners had liabilities of ₹3.94b due within 12 months, and liabilities of ₹6.78b due beyond 12 months. Offsetting this, it had ₹29.4m in cash and ₹1.86b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹8.83b.

This deficit casts a shadow over the ₹2.70b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Nitin Spinners would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Nitin Spinners's debt to EBITDA ratio (4.8) suggests that it uses some debt, its interest cover is very weak, at 1.5, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Investors should also be troubled by the fact that Nitin Spinners saw its EBIT drop by 16% over the last twelve months. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Nitin Spinners will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Nitin Spinners burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Nitin Spinners's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its EBIT growth rate also fails to instill confidence. Considering everything we've mentioned above, it's fair to say that Nitin Spinners is carrying heavy debt load. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 6 warning signs for Nitin Spinners (2 are potentially serious) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Nitin Spinners, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nitin Spinners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:NITINSPIN

Nitin Spinners

Manufactures and sells cotton and blended yarns, and knitted and woven fabrics in India and internationally.

Undervalued with adequate balance sheet.