If EPS Growth Is Important To You, Nahar Industrial Enterprises (NSE:NAHARINDUS) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Nahar Industrial Enterprises (NSE:NAHARINDUS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Nahar Industrial Enterprises

Nahar Industrial Enterprises' Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Impressively, Nahar Industrial Enterprises' EPS catapulted from ₹14.88 to ₹37.28, over the last year. It's a rarity to see 151% year-on-year growth like that.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Nahar Industrial Enterprises is growing revenues, and EBIT margins improved by 5.8 percentage points to 13%, over the last year. Both of which are great metrics to check off for potential growth.

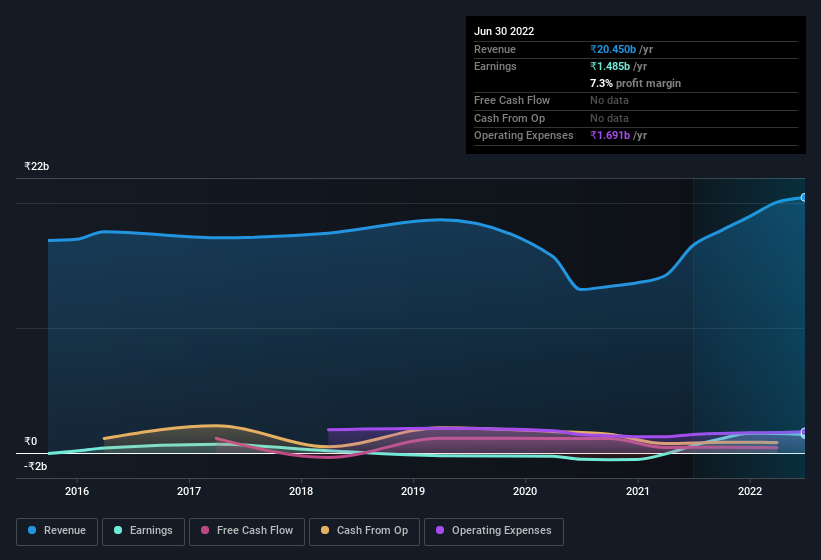

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Nahar Industrial Enterprises isn't a huge company, given its market capitalisation of ₹5.1b. That makes it extra important to check on its balance sheet strength.

Are Nahar Industrial Enterprises Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

A great takeaway for shareholders is that company insiders within Nahar Industrial Enterprises have collectively spent ₹2.8m acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling. It is also worth noting that it was Vice Chairman & MD Kamal Oswal who made the biggest single purchase, worth ₹935k, paying ₹116 per share.

Is Nahar Industrial Enterprises Worth Keeping An Eye On?

Nahar Industrial Enterprises' earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Nahar Industrial Enterprises on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Nahar Industrial Enterprises (of which 1 is a bit concerning!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Nahar Industrial Enterprises isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nahar Industrial Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAHARINDUS

Nahar Industrial Enterprises

Engages in the textile and sugar business in India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives