Nagreeka Exports' (NSE:NAGREEKEXP) Earnings Are Weaker Than They Seem

Despite posting some strong earnings, the market for Nagreeka Exports Limited's (NSE:NAGREEKEXP) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

View our latest analysis for Nagreeka Exports

Zooming In On Nagreeka Exports' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

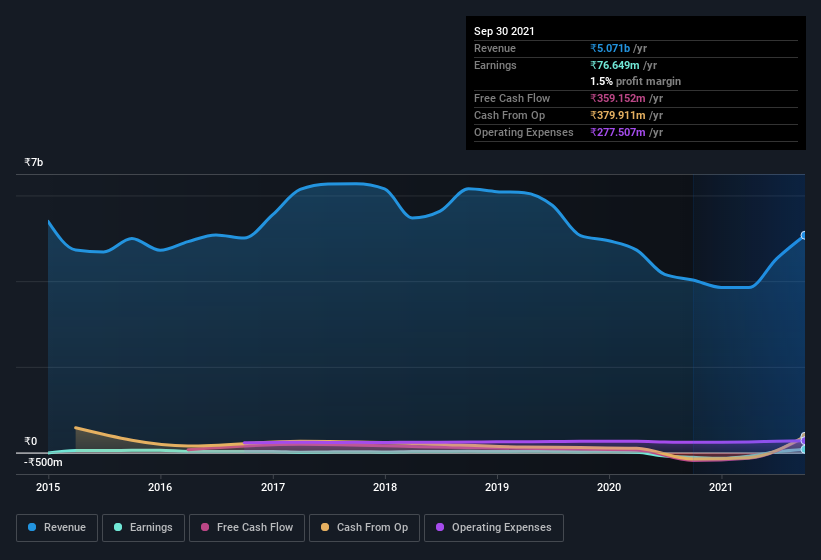

Over the twelve months to September 2021, Nagreeka Exports recorded an accrual ratio of -0.10. That indicates that its free cash flow was a fair bit more than its statutory profit. To wit, it produced free cash flow of ₹359m during the period, dwarfing its reported profit of ₹76.6m. Given that Nagreeka Exports had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₹359m would seem to be a step in the right direction. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nagreeka Exports.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Nagreeka Exports profited from a tax benefit which contributed ₹58m to profit. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Nagreeka Exports' Profit Performance

In conclusion, Nagreeka Exports has strong cashflow relative to earnings, which indicates good quality earnings, but the tax benefit means its profit wasn't as sustainable as we'd like to see. Based on these factors, we think it's very unlikely that Nagreeka Exports' statutory profits make it seem much weaker than it is. So while earnings quality is important, it's equally important to consider the risks facing Nagreeka Exports at this point in time. Every company has risks, and we've spotted 3 warning signs for Nagreeka Exports you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Nagreeka Exports might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NAGREEKEXP

Nagreeka Exports

Manufactures, sells, and exports cotton yarns and other various merchandise in India and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success