Exploring Monte Carlo Fashions And Two More Top Dividend Stocks In India

Reviewed by Simply Wall St

The Indian market has shown robust growth, climbing 2.7% in the last week and an impressive 45% over the past year, with earnings expected to grow by 16% annually. In such a thriving environment, dividend stocks like Monte Carlo Fashions offer potential stability and regular income, making them attractive options for investors looking to benefit from the current market conditions.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.12% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 3.88% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.05% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.68% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.19% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.63% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.22% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.69% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.48% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.33% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Monte Carlo Fashions (NSEI:MONTECARLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monte Carlo Fashions Limited is a company based in India that specializes in manufacturing and trading wool, cotton, and blended fabric apparels both domestically and internationally, with a market capitalization of ₹12.21 billion.

Operations: Monte Carlo Fashions Limited generates ₹10.62 billion in revenue primarily through the manufacturing and trading of textile garments.

Dividend Yield: 3.4%

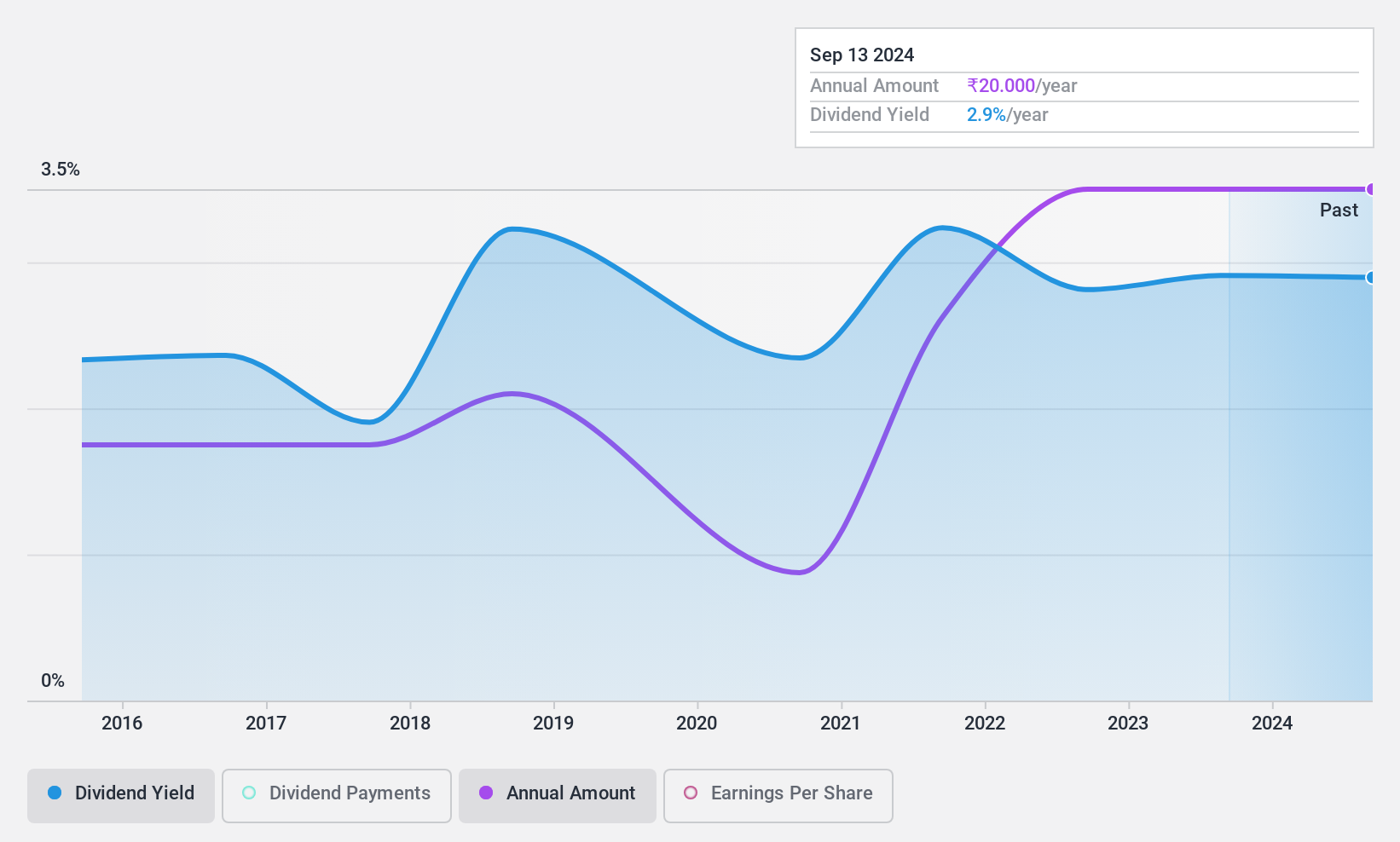

Monte Carlo Fashions recently declared a final dividend of INR 20 per share for FY 2023-2024, reflecting a commitment to shareholder returns despite a challenging year. The company's financial performance showed a downturn with net losses in Q4 and reduced annual revenue. While the dividend yield is competitive at 3.39%, higher than the Indian market average, concerns about its sustainability arise due to volatile dividend history over the past nine years and decreased profit margins from 11.9% to 5.6%. However, dividends are currently supported by earnings and cash flows with payout ratios of 69.2% and 88.8%, respectively.

- Click to explore a detailed breakdown of our findings in Monte Carlo Fashions' dividend report.

- In light of our recent valuation report, it seems possible that Monte Carlo Fashions is trading beyond its estimated value.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹33.96 billion.

Operations: Swaraj Engines Limited generates its revenue primarily from the production and sale of diesel engines, components, and spare parts for tractors, totaling ₹14.19 billion.

Dividend Yield: 3.4%

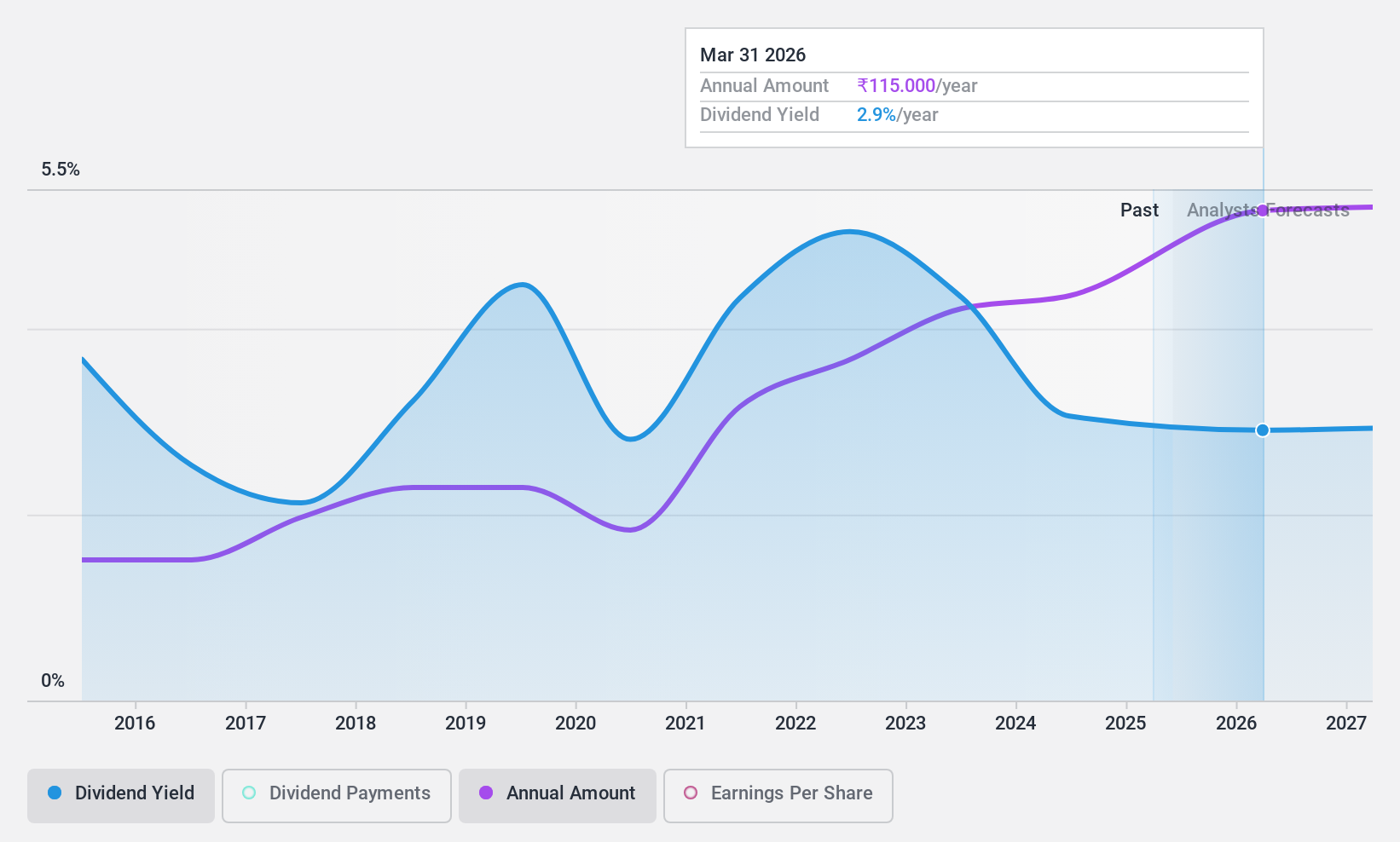

Swaraj Engines Limited recently recommended a substantial dividend of INR 95 per share, despite facing a minor regulatory penalty of INR 62,667, which is not expected to impact financials materially. The company's annual revenue and net income showed slight variations with revenues at INR 14.34 billion and net income increasing to INR 1.38 billion. However, the dividend sustainability is questionable as it's poorly covered by cash flows with a high payout ratio of 122%, indicating potential pressure on future payments unless profitability improves significantly.

- Click here to discover the nuances of Swaraj Engines with our detailed analytical dividend report.

- Our expertly prepared valuation report Swaraj Engines implies its share price may be lower than expected.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited operates in the manufacturing and sale of engineering systems, solutions, assemblies, and components mainly for off-highway vehicles across regions including India, the US, Asia Pacific, Europe, and Japan, with a market capitalization of approximately ₹23.06 billion.

Operations: Uniparts India Limited generates revenue primarily from the sale of linkage parts and components for off-highway vehicles, totaling ₹11.40 billion.

Dividend Yield: 3.8%

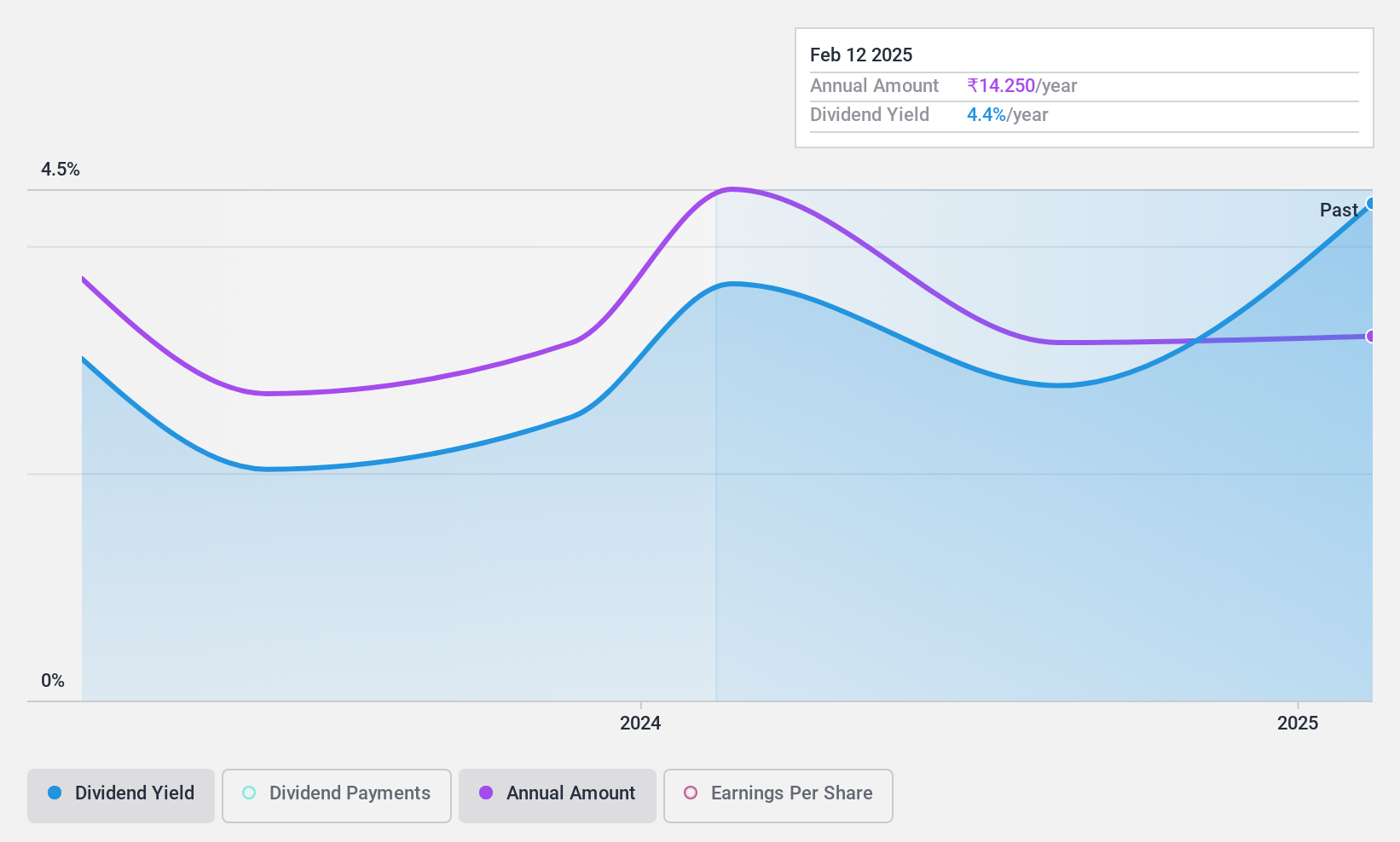

Uniparts India's recent financial performance shows a decline, with annual sales dropping to INR 11.40 billion from INR 13.66 billion, and net income falling to INR 1.25 billion from INR 2.05 billion. Despite this downturn, the company maintains a reasonable dividend coverage with earnings covering 62.6% and cash flows at 53.9%. However, it's too early to determine the reliability and growth of its dividends as they have only recently initiated dividend payments, although their current yield is competitive at 3.82%.

- Delve into the full analysis dividend report here for a deeper understanding of Uniparts India.

- The analysis detailed in our Uniparts India valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click here to access our complete index of 19 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MONTECARLO

Monte Carlo Fashions

Manufactures and trades in woolen, cotton, cotton-blended, knitted, and woven garments for men, women, and kids in India and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion