It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Marvel Decor (NSE:MDL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Marvel Decor with the means to add long-term value to shareholders.

Check out our latest analysis for Marvel Decor

How Fast Is Marvel Decor Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Marvel Decor managed to grow EPS by 9.0% per year, over three years. That's a good rate of growth, if it can be sustained.

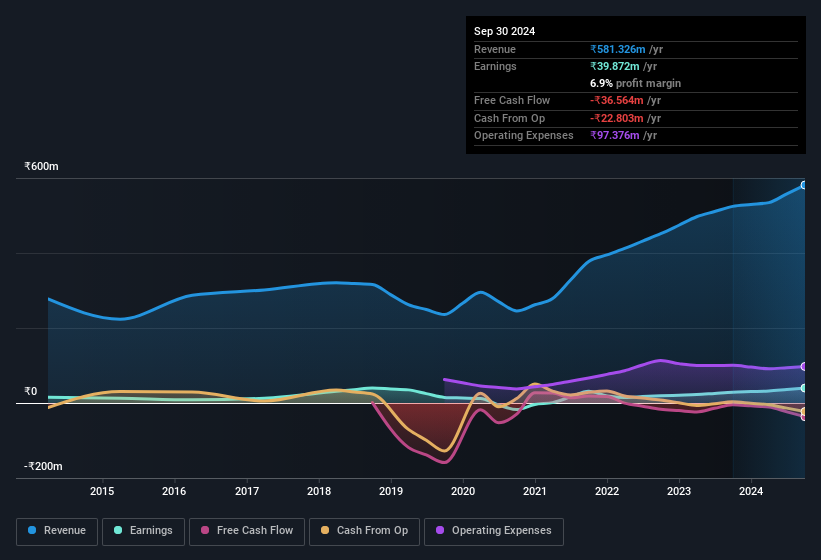

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Marvel Decor maintained stable EBIT margins over the last year, all while growing revenue 11% to ₹581m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Marvel Decor isn't a huge company, given its market capitalisation of ₹1.6b. That makes it extra important to check on its balance sheet strength.

Are Marvel Decor Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that Marvel Decor insiders netted ₹45m worth of shares over the last year. But the silver lining to that cloud is that Ashok Paun, the Executive Chairman & MD, spent ₹46m buying shares at an average price of ₹107. Overall, that is something good to take away.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Marvel Decor will reveal that insiders own a significant piece of the pie. In fact, they own 76% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Marvel Decor is a very small company, with a market cap of only ₹1.6b. So this large proportion of shares owned by insiders only amounts to ₹1.2b. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Does Marvel Decor Deserve A Spot On Your Watchlist?

As previously touched on, Marvel Decor is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Marvel Decor (1 is potentially serious) you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Marvel Decor isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MDL

Marvel Decor

Manufactures and supplies window covering fashion blinds and components for window covering blind making companies.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives