Market Cool On Manomay Tex India Limited's (NSE:MANOMAY) Earnings Pushing Shares 25% Lower

Manomay Tex India Limited (NSE:MANOMAY) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 70% in the last year.

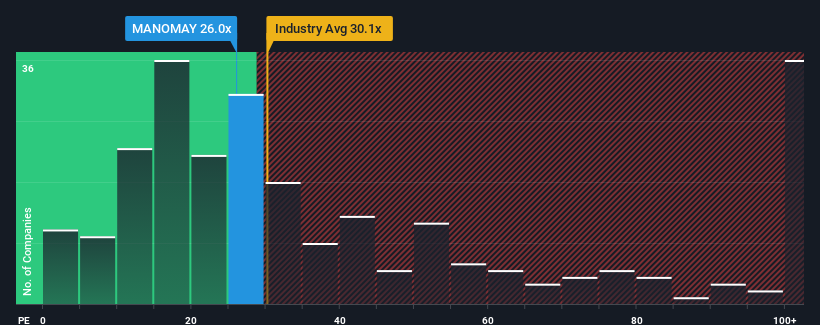

Even after such a large drop in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 35x, you may still consider Manomay Tex India as an attractive investment with its 26x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

The earnings growth achieved at Manomay Tex India over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Manomay Tex India

How Is Manomay Tex India's Growth Trending?

In order to justify its P/E ratio, Manomay Tex India would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 9.4%. This was backed up an excellent period prior to see EPS up by 97% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 25% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Manomay Tex India's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Manomay Tex India's P/E?

Manomay Tex India's recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Manomay Tex India revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Manomay Tex India (1 doesn't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MANOMAY

Manomay Tex India

Manufactures and sells denims and denim fabrics in India.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives