Why Investors Shouldn't Be Surprised By Lux Industries Limited's (NSE:LUXIND) 30% Share Price Surge

Lux Industries Limited (NSE:LUXIND) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 4.3% isn't as impressive.

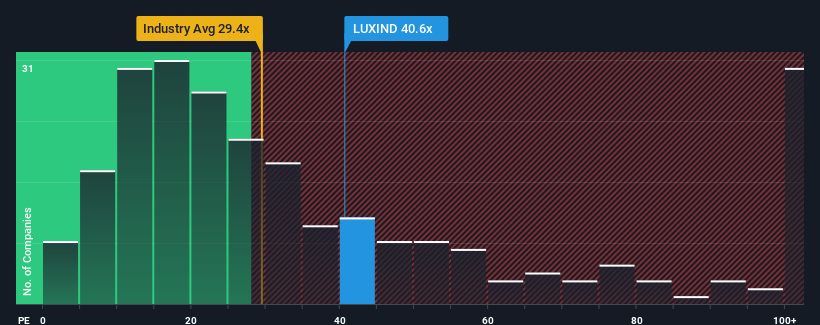

After such a large jump in price, Lux Industries' price-to-earnings (or "P/E") ratio of 40.6x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

While the market has experienced earnings growth lately, Lux Industries' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Lux Industries

Does Growth Match The High P/E?

Lux Industries' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. As a result, earnings from three years ago have also fallen 47% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 131% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

With this information, we can see why Lux Industries is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Lux Industries' P/E

The large bounce in Lux Industries' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Lux Industries maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Lux Industries that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LUXIND

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives