Kalyan Jewellers India Limited's (NSE:KALYANKJIL) 27% Jump Shows Its Popularity With Investors

Kalyan Jewellers India Limited (NSE:KALYANKJIL) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 241% following the latest surge, making investors sit up and take notice.

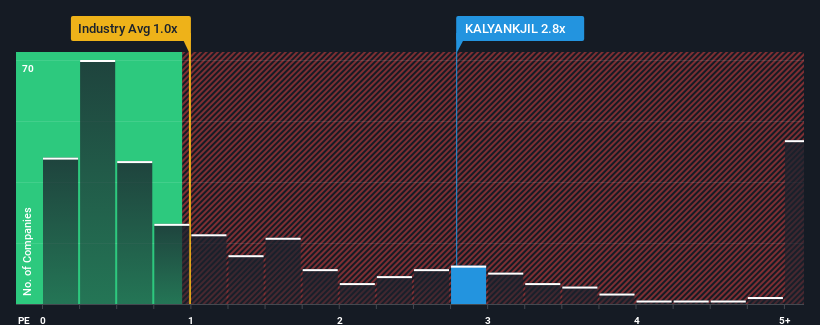

Following the firm bounce in price, you could be forgiven for thinking Kalyan Jewellers India is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in India's Luxury industry have P/S ratios below 1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kalyan Jewellers India

What Does Kalyan Jewellers India's Recent Performance Look Like?

Kalyan Jewellers India certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kalyan Jewellers India.How Is Kalyan Jewellers India's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kalyan Jewellers India's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. The latest three year period has also seen an excellent 116% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 15% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Kalyan Jewellers India's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Kalyan Jewellers India shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Kalyan Jewellers India maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Luxury industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kalyan Jewellers India, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Kalyan Jewellers India, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kalyan Jewellers India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KALYANKJIL

Kalyan Jewellers India

Manufactures and retails various gold and precious stone studded jewelry products.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives