Here's Why We Think Kalyan Jewellers India (NSE:KALYANKJIL) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kalyan Jewellers India (NSE:KALYANKJIL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kalyan Jewellers India with the means to add long-term value to shareholders.

See our latest analysis for Kalyan Jewellers India

How Quickly Is Kalyan Jewellers India Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Kalyan Jewellers India has grown EPS by 53% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

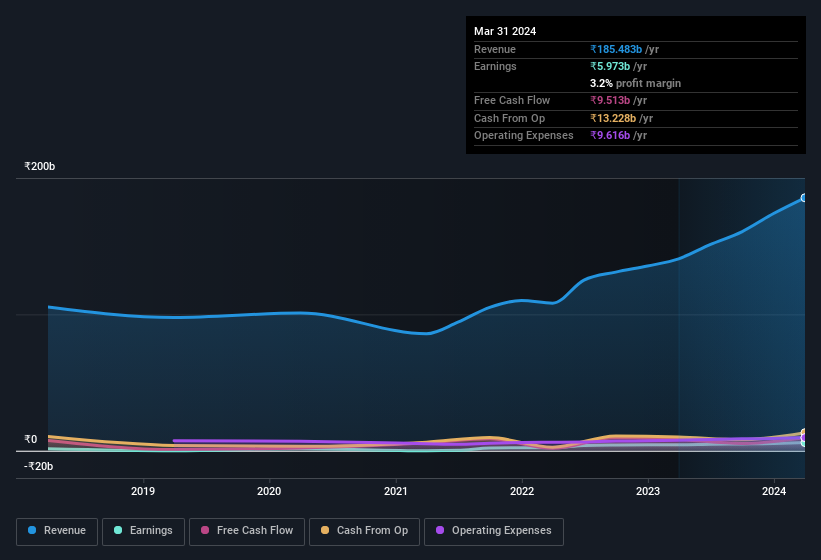

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Kalyan Jewellers India maintained stable EBIT margins over the last year, all while growing revenue 32% to ₹185b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Kalyan Jewellers India?

Are Kalyan Jewellers India Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Kalyan Jewellers India insiders own a meaningful share of the business. In fact, they own 61% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. ₹247b That level of investment from insiders is nothing to sneeze at.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between ₹333b and ₹1.0t, like Kalyan Jewellers India, the median CEO pay is around ₹46m.

The Kalyan Jewellers India CEO received total compensation of just ₹16m in the year to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Kalyan Jewellers India To Your Watchlist?

Kalyan Jewellers India's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Kalyan Jewellers India certainly ticks a few boxes, so we think it's probably well worth further consideration. Before you take the next step you should know about the 2 warning signs for Kalyan Jewellers India that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kalyan Jewellers India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KALYANKJIL

Kalyan Jewellers India

Manufactures and retails various gold and precious stone studded jewelry products.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives