- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India Limited's (NSE:JCHAC) Popularity With Investors Is Clear

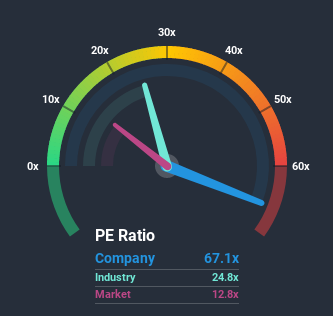

Johnson Controls-Hitachi Air Conditioning India Limited's (NSE:JCHAC) price-to-earnings (or "P/E") ratio of 67.1x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Johnson Controls-Hitachi Air Conditioning India over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Johnson Controls-Hitachi Air Conditioning India

Is There Enough Growth For Johnson Controls-Hitachi Air Conditioning India?

In order to justify its P/E ratio, Johnson Controls-Hitachi Air Conditioning India would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.0%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 1.5% shows it's a great look while it lasts.

With this information, we can see why Johnson Controls-Hitachi Air Conditioning India is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Johnson Controls-Hitachi Air Conditioning India revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

Having said that, be aware Johnson Controls-Hitachi Air Conditioning India is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Johnson Controls-Hitachi Air Conditioning India, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Johnson Controls-Hitachi Air Conditioning India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives