- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Increasing losses over three years doesn't faze Johnson Controls-Hitachi Air Conditioning India (NSE:JCHAC) investors as stock pops 13% this past week

This week we saw the Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) share price climb by 13%. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 51% in the last three years. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Johnson Controls-Hitachi Air Conditioning India

Because Johnson Controls-Hitachi Air Conditioning India made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Johnson Controls-Hitachi Air Conditioning India grew revenue at 13% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 15% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

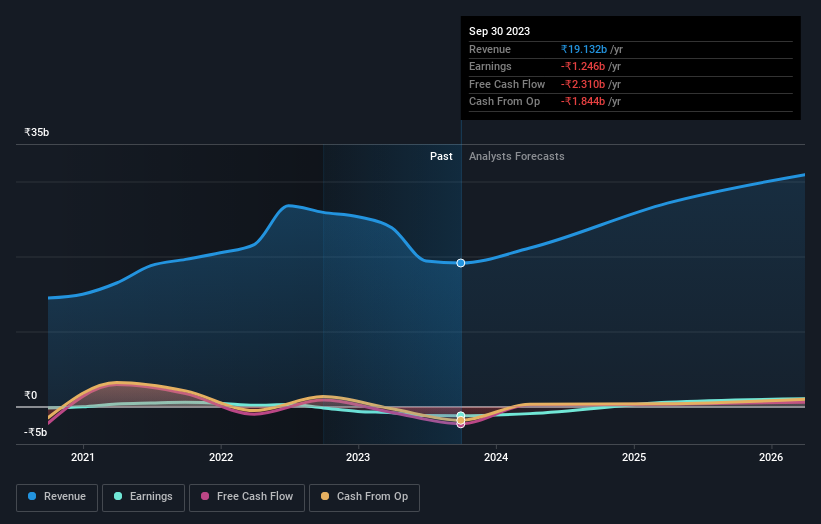

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Johnson Controls-Hitachi Air Conditioning India provided a TSR of 11% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. So this might be a sign the business has turned its fortunes around. You could get a better understanding of Johnson Controls-Hitachi Air Conditioning India's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bosch Home Comfort India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JCHAC

Bosch Home Comfort India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion