- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

How Does Johnson Controls-Hitachi Air Conditioning India's (NSE:JCHAC) P/E Compare To Its Industry, After Its Big Share Price Gain?

Johnson Controls-Hitachi Air Conditioning India (NSE:JCHAC) shares have continued recent momentum with a 35% gain in the last month alone. That brought the twelve month gain to a very sharp 68%.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

Check out our latest analysis for Johnson Controls-Hitachi Air Conditioning India

How Does Johnson Controls-Hitachi Air Conditioning India's P/E Ratio Compare To Its Peers?

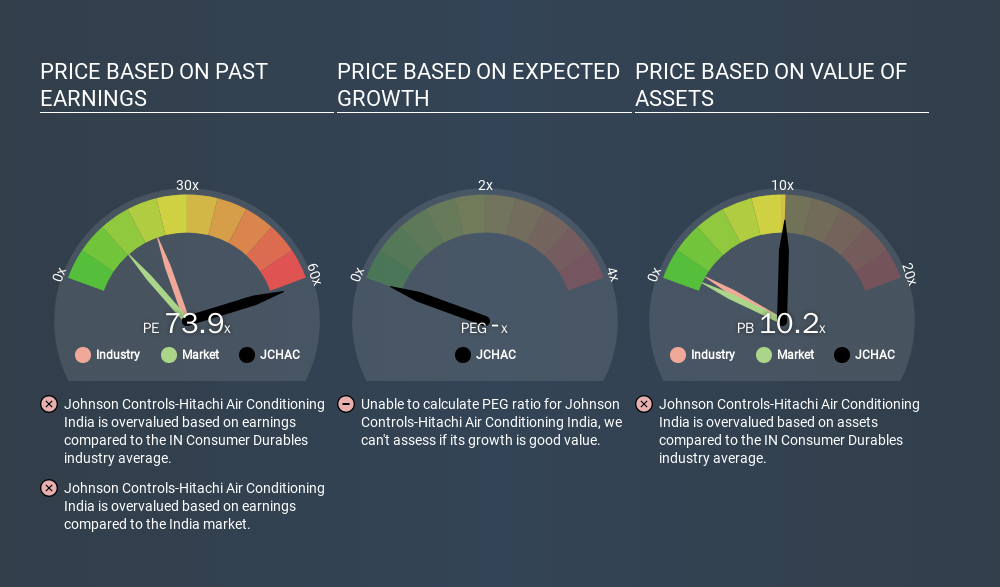

Johnson Controls-Hitachi Air Conditioning India's P/E of 73.87 indicates some degree of optimism towards the stock. The image below shows that Johnson Controls-Hitachi Air Conditioning India has a significantly higher P/E than the average (21.7) P/E for companies in the consumer durables industry.

Its relatively high P/E ratio indicates that Johnson Controls-Hitachi Air Conditioning India shareholders think it will perform better than other companies in its industry classification. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Notably, Johnson Controls-Hitachi Air Conditioning India grew EPS by a whopping 41% in the last year. And it has bolstered its earnings per share by 14% per year over the last five years. With that performance, I would expect it to have an above average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does Johnson Controls-Hitachi Air Conditioning India's Debt Impact Its P/E Ratio?

Since Johnson Controls-Hitachi Air Conditioning India holds net cash of ₹1.6b, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Verdict On Johnson Controls-Hitachi Air Conditioning India's P/E Ratio

With a P/E ratio of 73.9, Johnson Controls-Hitachi Air Conditioning India is expected to grow earnings very strongly in the years to come. The excess cash it carries is the gravy on top its fast EPS growth. So based on this analysis we'd expect Johnson Controls-Hitachi Air Conditioning India to have a high P/E ratio. What is very clear is that the market has become significantly more optimistic about Johnson Controls-Hitachi Air Conditioning India over the last month, with the P/E ratio rising from 54.9 back then to 73.9 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

You might be able to find a better buy than Johnson Controls-Hitachi Air Conditioning India. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:JCHAC

Bosch Home Comfort India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion