- India

- /

- Consumer Durables

- /

- NSEI:IFBIND

IFB Industries And Two Other Undiscovered Gems In India

Reviewed by Simply Wall St

The Indian market has shown remarkable growth, rising 2.3% in the past week and achieving a 45% increase over the last year with earnings expected to grow by 16% annually. In such a thriving environment, uncovering lesser-known stocks that demonstrate strong potential for growth can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| AGI Infra | 61.29% | 29.69% | 35.60% | ★★★★★★ |

| Alembic | 0.42% | 11.74% | -6.39% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Focus Lighting and Fixtures | 4.44% | 24.11% | 67.92% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Sanstar | 50.30% | 37.73% | 58.24% | ★★★★☆☆ |

| Share India Securities | 23.33% | 37.66% | 48.98% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited operates in the manufacturing and trading of home appliances both within India and internationally, with a market capitalization of ₹74.57 billion.

Operations: The company generates revenue through the sale of goods, incurring significant costs primarily from the cost of goods sold (COGS) and operating expenses. Over recent periods, it has seen a gross profit margin around 39.59%, indicating the percentage of revenue exceeding direct production costs.

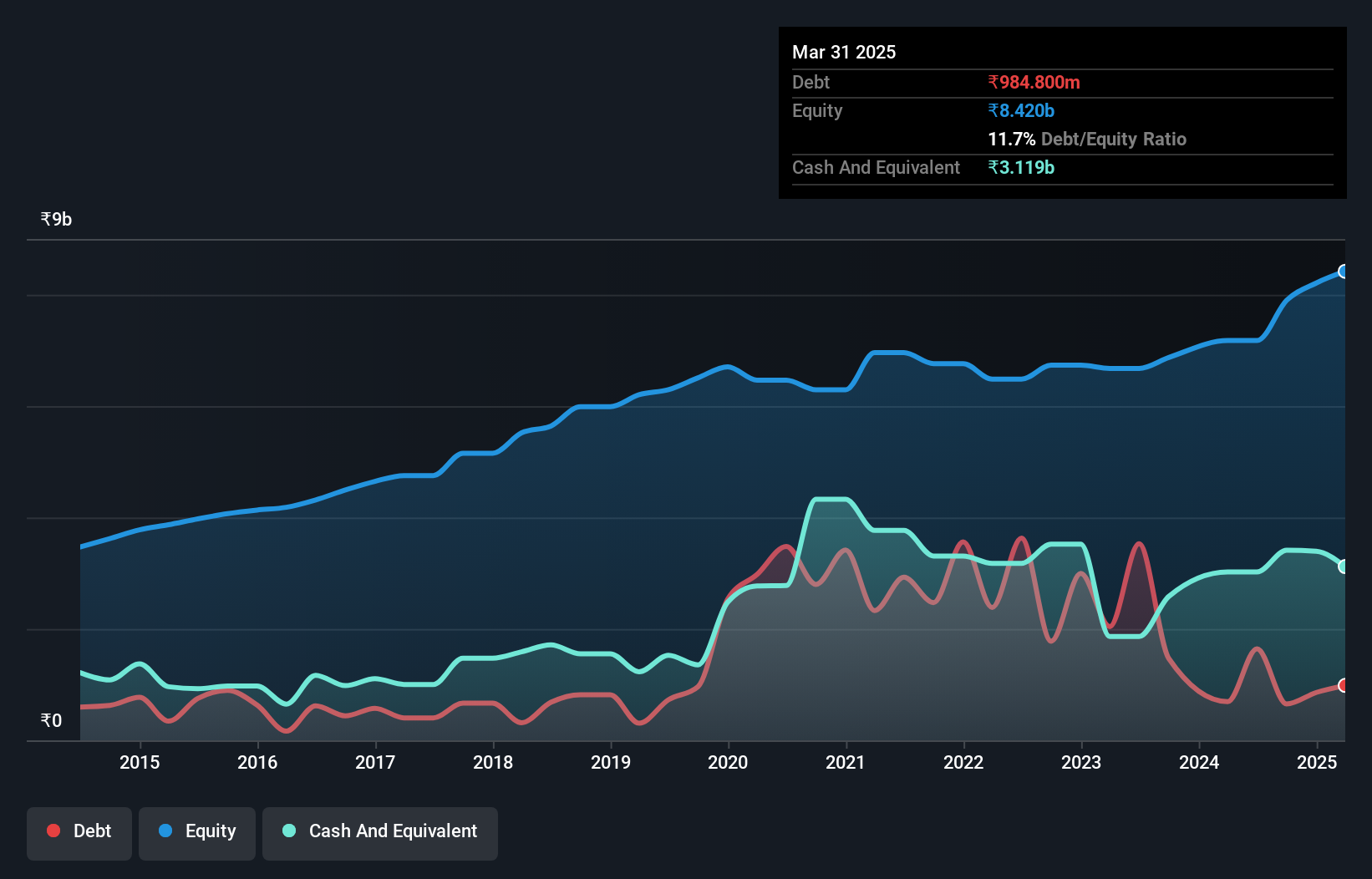

IFB Industries, a notable player in the Consumer Durables sector, has demonstrated remarkable financial performance with a 612.7% earnings growth over the past year, significantly outpacing its industry's average of 15.5%. This growth trajectory is supported by robust fundamentals, including more cash on hand than total debt and interest payments well-covered by EBIT at 7.5 times coverage. Despite a volatile share price recently, IFB's strategic maneuvers and solid earnings base suggest it could be an intriguing prospect for those looking into lesser-explored avenues of the Indian market.

- Click here to discover the nuances of IFB Industries with our detailed analytical health report.

Explore historical data to track IFB Industries' performance over time in our Past section.

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited is a company based in India that specializes in the manufacturing and marketing of iron and steel products, with a market capitalization of approximately ₹158.76 billion.

Operations: The company generates its revenue primarily from the iron and steel sector, with a notable increase in gross profit margin from 8.59% in March 2014 to 35.40% by July 2024, reflecting significant improvements in operational efficiency over the decade. This growth trajectory is underscored by a substantial rise in net income from consistent losses to ₹8.80 billion by mid-2024, indicating robust financial recovery and profitability enhancement strategies.

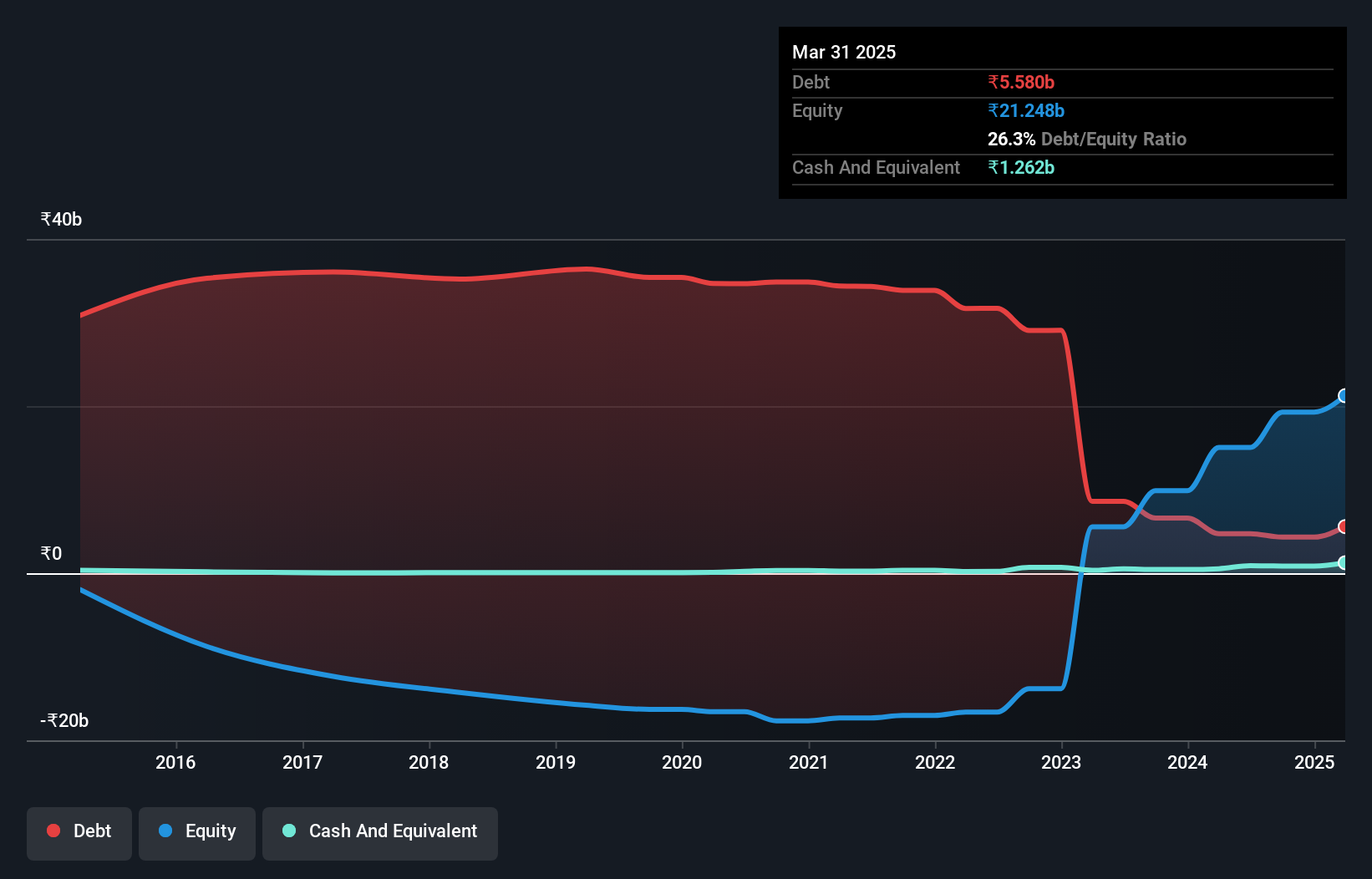

Jai Balaji Industries, a lesser-known player in the Indian metals and mining sector, has demonstrated remarkable financial agility. With an earnings growth of 1421% over the past year, it significantly outpaces its industry's average growth of 19%. The company's debt is well-managed with a net debt to equity ratio of 25%, deemed satisfactory. Moreover, its EBIT covers interest payments by a robust 11.3 times. Recent strategic moves include a private placement that raised INR 225 million, enhancing its financial flexibility for future endeavors.

Prudent Advisory Services (NSEI:PRUDENT)

Simply Wall St Value Rating: ★★★★★★

Overview: Prudent Corporate Advisory Services Limited offers advisory and distribution services for various mutual funds, catering to individuals, corporates, high net worth individuals (HNIs), and ultra HNIs both domestically and internationally, with a market capitalization of ₹97.63 billion.

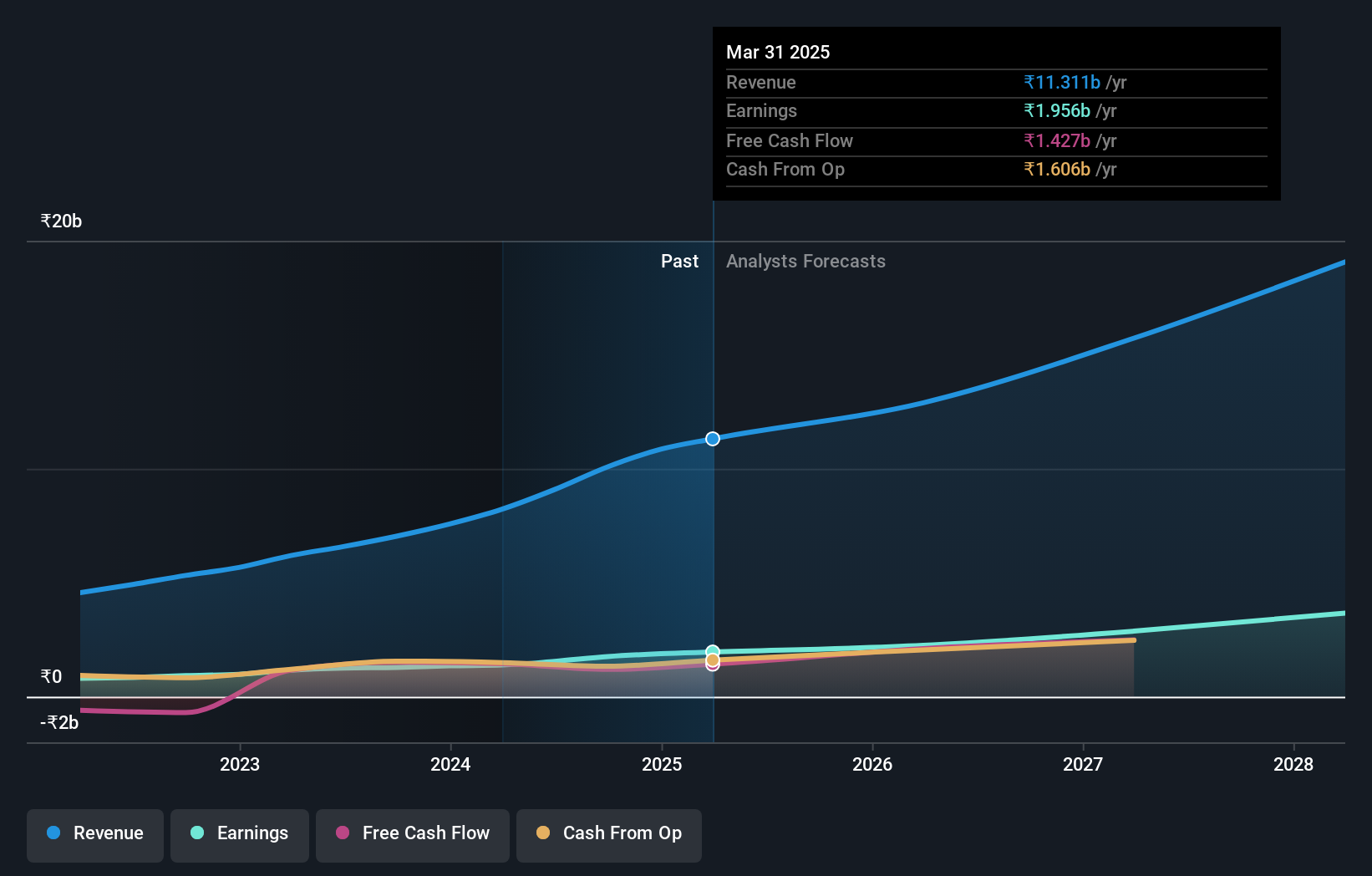

Operations: Prudent Advisory Services generates its revenue primarily through the distribution and sale of financial products, achieving a revenue of ₹8.23 billion as of the latest report. The company has seen an increase in both gross profit and operating expenses over recent years, reflecting its expanding operations and scale.

Prudent Corporate Advisory Services, a notable player in the Capital Markets industry, showcases robust financial health with zero debt and high-quality earnings. Over the past five years, earnings have surged by 28.8% annually. Despite not outpacing its industry's growth rate last year, Prudent has demonstrated resilience with a 22.77% projected annual earnings growth. Recent events include a proposed dividend increase and shareholder meetings focused on amalgamation schemes, indicating active corporate governance and strategic expansion efforts.

Summing It All Up

- Discover the full array of 457 Indian Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IFBIND

IFB Industries

Manufactures and trades in home appliances in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026