Party Time: Brokers Just Made Major Increases To Their Himatsingka Seide Limited (NSE:HIMATSEIDE) Earnings Forecasts

Celebrations may be in order for Himatsingka Seide Limited (NSE:HIMATSEIDE) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 14% to ₹275 in the last 7 days. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

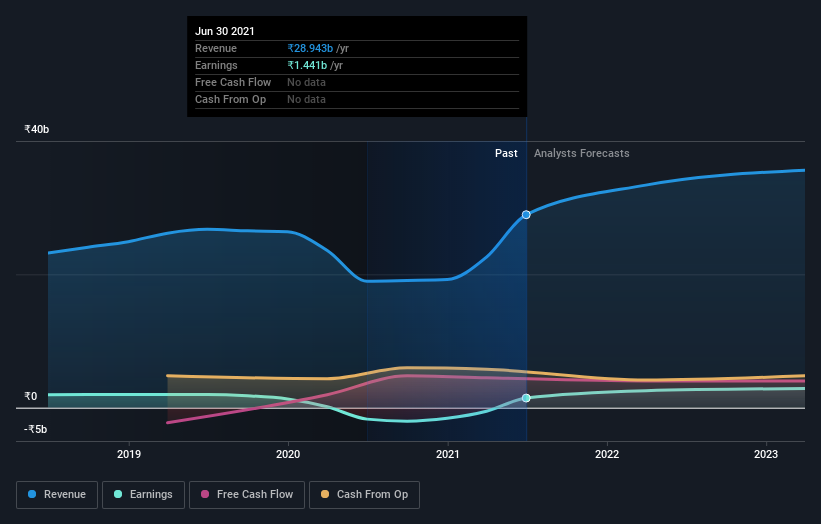

Following the upgrade, the most recent consensus for Himatsingka Seide from its twin analysts is for revenues of ₹33b in 2022 which, if met, would be a meaningful 15% increase on its sales over the past 12 months. Statutory earnings per share are presumed to jump 76% to ₹25.80. Before this latest update, the analysts had been forecasting revenues of ₹30b and earnings per share (EPS) of ₹22.20 in 2022. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for Himatsingka Seide

It will come as no surprise to learn that the analysts have increased their price target for Himatsingka Seide 10% to ₹291 on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Himatsingka Seide analyst has a price target of ₹375 per share, while the most pessimistic values it at ₹209. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Himatsingka Seide's growth to accelerate, with the forecast 21% annualised growth to the end of 2022 ranking favourably alongside historical growth of 3.0% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 17% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Himatsingka Seide is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue forecasts, although the latest estimates suggest that Himatsingka Seide will grow in line with the overall market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Himatsingka Seide could be worth investigating further.

Better yet, our automated discounted cash flow calculation (DCF) suggests Himatsingka Seide could be moderately undervalued. For more information, you can click through to our platform to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Himatsingka Seide, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Himatsingka Seide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HIMATSEIDE

Himatsingka Seide

Designs, develops, manufactures, distributes, and retails home textile products in North America, India, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Solid track record with mediocre balance sheet.