Such Is Life: How Future Enterprises Shareholders Saw Their Shares Drop 70%

Investing in stocks inevitably means buying into some companies that perform poorly. Long term Future Enterprises Limited (NSE:FELDVR) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 70% decline in the share price in that time. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Future Enterprises

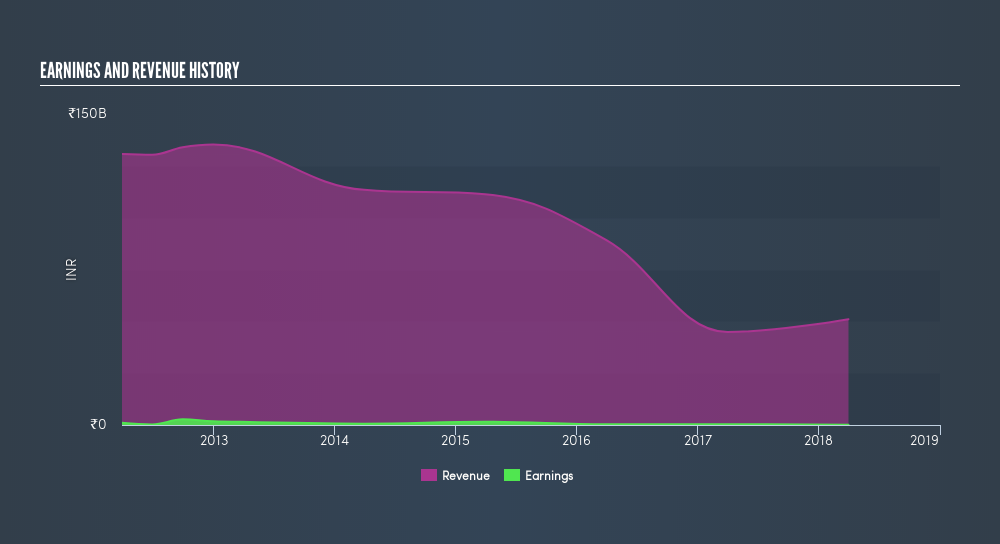

Given that Future Enterprises only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. That's because it's hard for shareholders to have confidence a company will grow profits significantly if it isn't growing revenue.

Over the last three years, Future Enterprises's revenue dropped 30% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 33% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Future Enterprises's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Future Enterprises's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. Future Enterprises's TSR of was a loss of 69% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Future Enterprises shareholders are down 9.9% for the year. Unfortunately, that's worse than the broader market decline of 4.1%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 0.5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:FELDVR

Future Enterprises

Together with its subsidiaries engages in the retail business in India.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives