Dixon Technologies (India) Leads Three High Insider Ownership Growth Stocks On The Indian Exchange

Reviewed by Simply Wall St

The Indian market has shown robust growth, increasing by 1.7% over the last week and surging 45% over the past 12 months, with earnings projected to grow by 16% per annum. In such a thriving environment, stocks like Dixon Technologies (India), which combine high insider ownership with substantial growth prospects, are particularly noteworthy.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

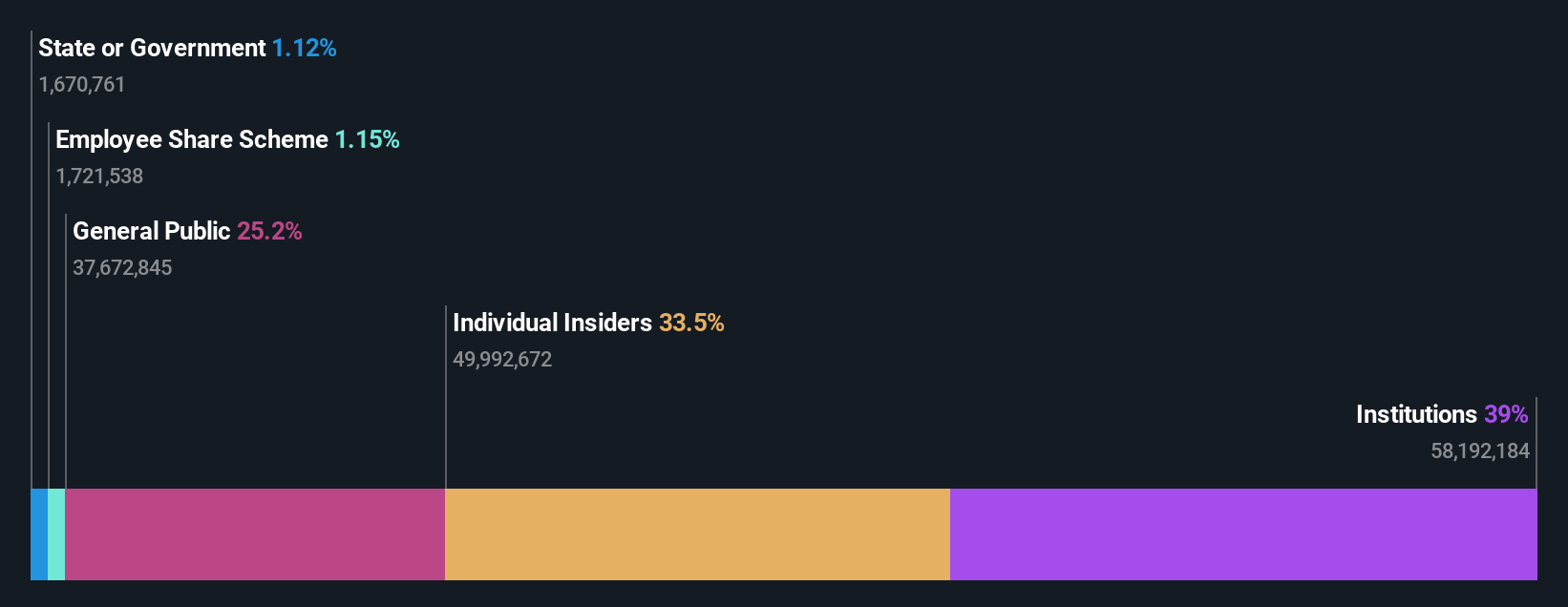

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.2% |

Let's dive into some prime choices out of from the screener.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

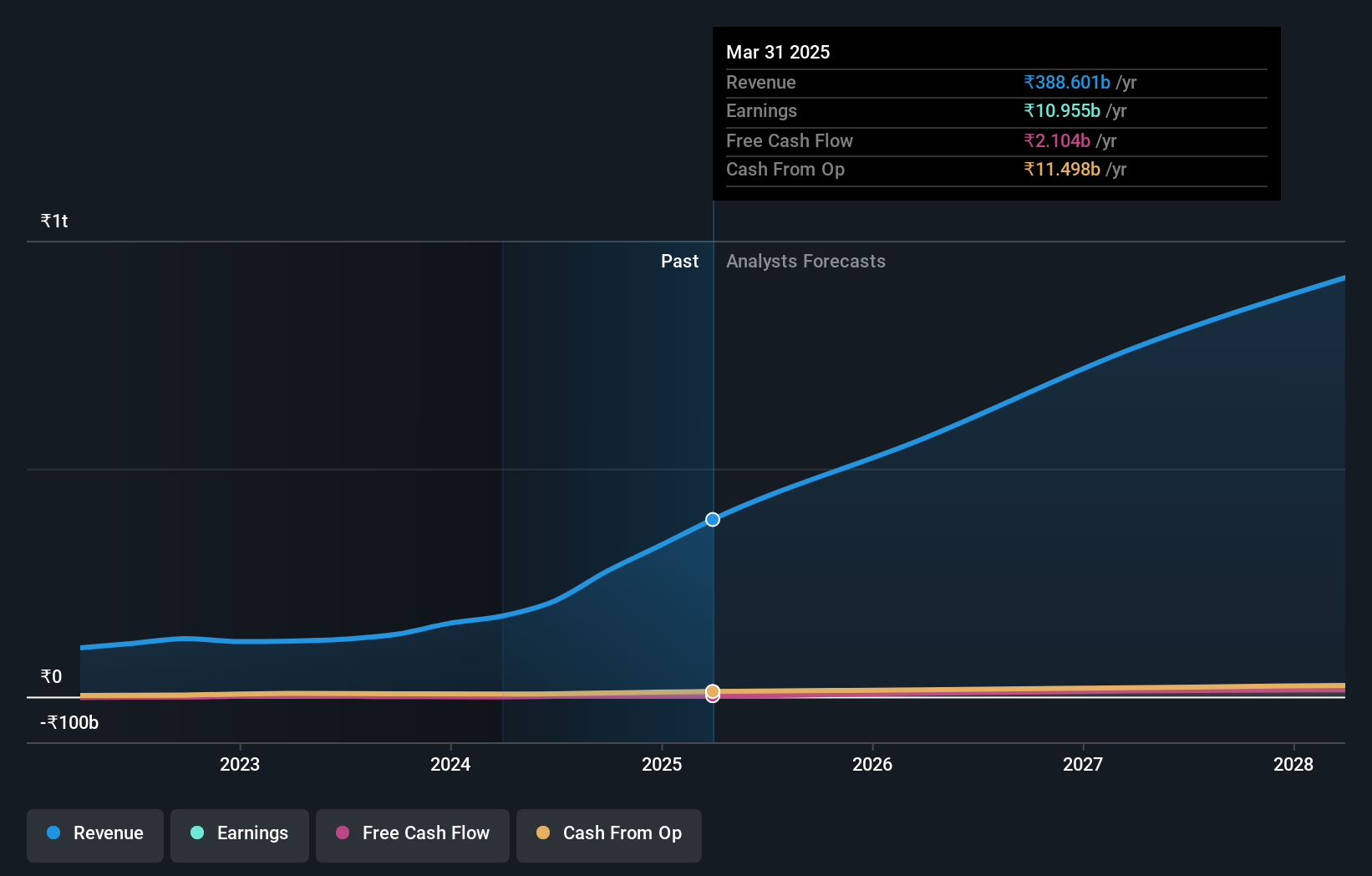

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services across India, with a market capitalization of approximately ₹74.90 billion.

Operations: The company's revenue is primarily generated from five segments: Home Appliances (₹12.05 billion), Security Systems (₹6.33 billion), Lighting Products (₹7.87 billion), Mobile & EMS Division (₹109.19 billion), and Consumer Electronics & Appliances (₅41.48 billion).

Insider Ownership: 24.9%

Return On Equity Forecast: 30% (2027 estimate)

Dixon Technologies, a key player in India's electronics manufacturing sector, has demonstrated robust growth with its full-year revenue reaching INR 177.13 billion, up from INR 121.98 billion the previous year. The company's net income also saw a significant rise to INR 3.68 billion. Recent strategic moves include a MOU with Acerpure India for manufacturing consumer appliances, enhancing its product base and potential market share. Despite no recent insider buying or selling reported, Dixon is expected to sustain high earnings growth at an annual rate of 33.7% over the next three years, outpacing broader market expectations.

- Unlock comprehensive insights into our analysis of Dixon Technologies (India) stock in this growth report.

- In light of our recent valuation report, it seems possible that Dixon Technologies (India) is trading beyond its estimated value.

Jupiter Wagons (NSEI:JWL)

Simply Wall St Growth Rating: ★★★★★★

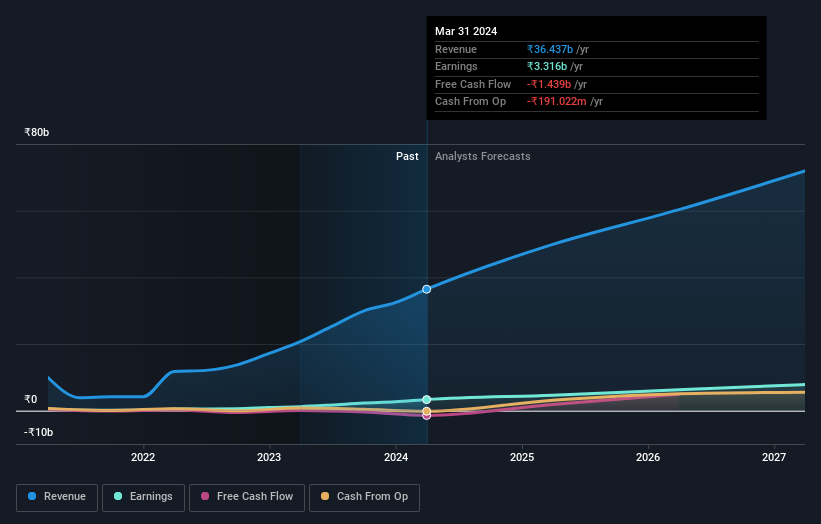

Overview: Jupiter Wagons Limited is a company that manufactures and sells mobility solutions both in India and internationally, with a market capitalization of approximately ₹28.12 billion.

Operations: The company's revenue from auto manufacturers totals approximately ₹36.44 billion.

Insider Ownership: 11.1%

Return On Equity Forecast: 26% (2027 estimate)

Jupiter Wagons, an Indian firm with high insider ownership, has been active in capital market activities, including a recent private placement and proposals for securities issuance. Despite shareholder dilution over the past year, Jupiter Wagons reported substantial revenue growth to INR 36.68 billion and a net income increase to INR 3.32 billion in FY2024. However, its share price has been highly volatile recently. The company's earnings are expected to grow significantly over the next three years, outpacing broader market forecasts.

- Dive into the specifics of Jupiter Wagons here with our thorough growth forecast report.

- Our expertly prepared valuation report Jupiter Wagons implies its share price may be too high.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited operates globally, offering software products, services, and technology solutions with a market capitalization of approximately ₹66.13 billion.

Operations: The company generates revenue through three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

Insider Ownership: 34.3%

Return On Equity Forecast: 26% (2027 estimate)

Persistent Systems, a growth-focused company with high insider ownership, has shown robust financial performance with a year-on-year earnings increase of 18.7%. The company's revenue is projected to grow at 13.4% annually, outpacing the Indian market forecast of 9.6%. Despite recent executive changes and a minor regulatory fine in its Netherlands branch, Persistent Systems continues to innovate, as evidenced by the launch of GenAI Hub and iAURA platforms aimed at enhancing enterprise AI applications. These initiatives are expected to support continued revenue and profit growth.

- Click to explore a detailed breakdown of our findings in Persistent Systems' earnings growth report.

- The analysis detailed in our Persistent Systems valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Discover the full array of 83 Fast Growing Indian Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JWL

Jupiter Wagons

Manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally.

High growth potential with excellent balance sheet.