Even With A 29% Surge, Cautious Investors Are Not Rewarding DCM Nouvelle Limited's (NSE:DCMNVL) Performance Completely

DCM Nouvelle Limited (NSE:DCMNVL) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

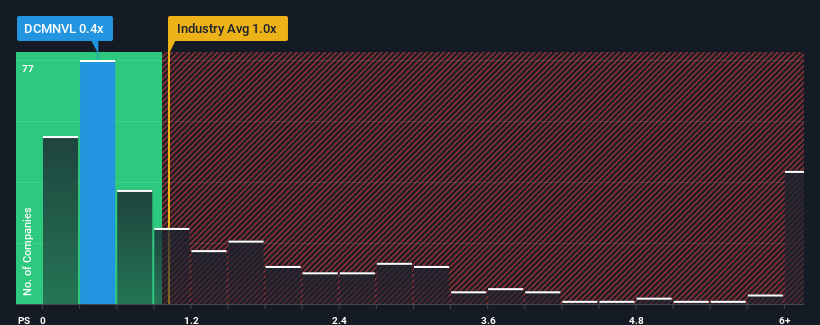

Although its price has surged higher, it would still be understandable if you think DCM Nouvelle is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in India's Luxury industry have P/S ratios above 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for DCM Nouvelle

What Does DCM Nouvelle's P/S Mean For Shareholders?

The revenue growth achieved at DCM Nouvelle over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on DCM Nouvelle's earnings, revenue and cash flow.How Is DCM Nouvelle's Revenue Growth Trending?

In order to justify its P/S ratio, DCM Nouvelle would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The latest three year period has also seen an excellent 92% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this information, we find it odd that DCM Nouvelle is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On DCM Nouvelle's P/S

DCM Nouvelle's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see DCM Nouvelle currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for DCM Nouvelle (1 shouldn't be ignored!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DCMNVL

DCM Nouvelle

Manufactures, exports, and sells cotton yarn in India, Bangladesh, China, Egypt, Guatemala, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives