Is Bombay Dyeing and Manufacturing (NSE:BOMDYEING) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies The Bombay Dyeing and Manufacturing Company Limited (NSE:BOMDYEING) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Bombay Dyeing and Manufacturing

How Much Debt Does Bombay Dyeing and Manufacturing Carry?

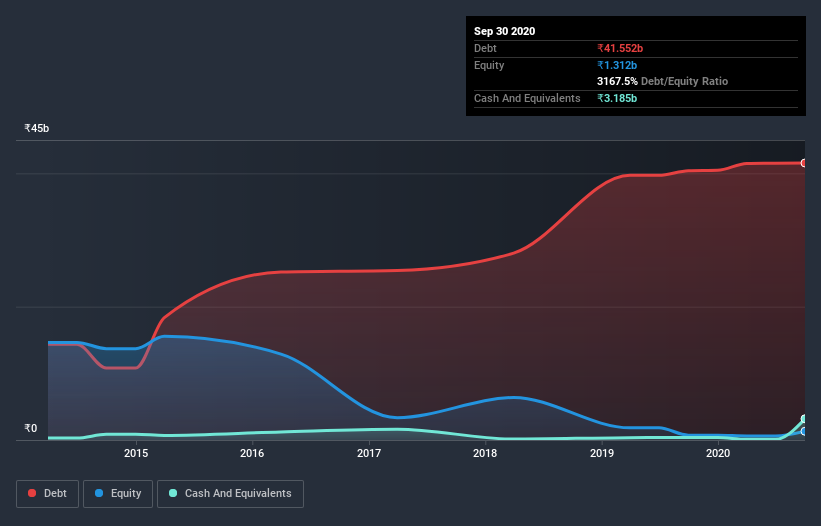

As you can see below, Bombay Dyeing and Manufacturing had ₹41.6b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of ₹3.19b, its net debt is less, at about ₹38.4b.

How Healthy Is Bombay Dyeing and Manufacturing's Balance Sheet?

We can see from the most recent balance sheet that Bombay Dyeing and Manufacturing had liabilities of ₹19.5b falling due within a year, and liabilities of ₹30.9b due beyond that. On the other hand, it had cash of ₹3.19b and ₹6.80b worth of receivables due within a year. So it has liabilities totalling ₹40.4b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₹17.0b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Bombay Dyeing and Manufacturing would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is Bombay Dyeing and Manufacturing's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Bombay Dyeing and Manufacturing had a loss before interest and tax, and actually shrunk its revenue by 77%, to ₹10.0b. That makes us nervous, to say the least.

Caveat Emptor

While Bombay Dyeing and Manufacturing's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at ₹856m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. It's fair to say the loss of ₹82m didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Bombay Dyeing and Manufacturing has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Bombay Dyeing and Manufacturing or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bombay Dyeing and Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BOMDYEING

Bombay Dyeing and Manufacturing

Produces and sells polyester staple fiber products in India and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.