Do Bhandari Hosiery Exports' (NSE:BHANDARI) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Bhandari Hosiery Exports (NSE:BHANDARI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Our analysis indicates that BHANDARI is potentially undervalued!

Bhandari Hosiery Exports' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Bhandari Hosiery Exports managed to grow EPS by 5.5% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

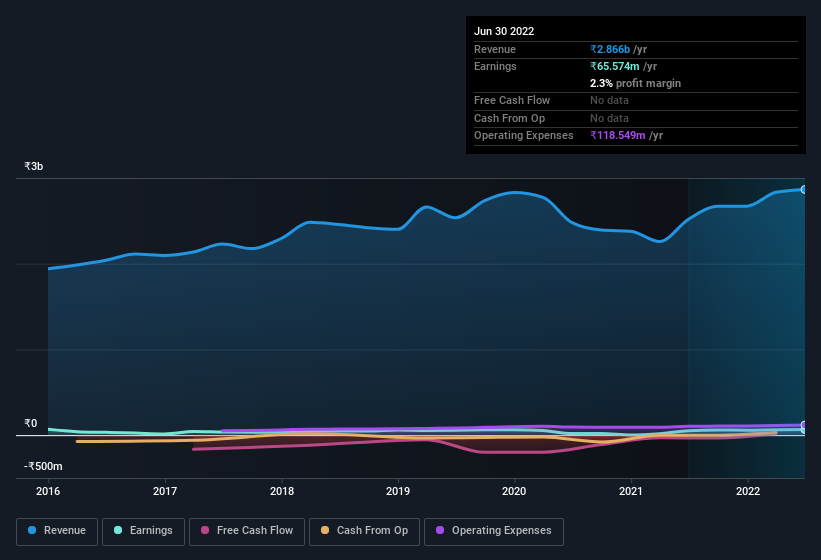

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Bhandari Hosiery Exports remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 14% to ₹2.9b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Bhandari Hosiery Exports isn't a huge company, given its market capitalisation of ₹689m. That makes it extra important to check on its balance sheet strength.

Are Bhandari Hosiery Exports Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Bhandari Hosiery Exports will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 47% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Bhandari Hosiery Exports is a very small company, with a market cap of only ₹689m. So despite a large proportional holding, insiders only have ₹324m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Bhandari Hosiery Exports Worth Keeping An Eye On?

As previously touched on, Bhandari Hosiery Exports is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We should say that we've discovered 2 warning signs for Bhandari Hosiery Exports that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bhandari Hosiery Exports might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHANDARI

Bhandari Hosiery Exports

Operates as a textile and garments manufacturing company in India and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives