Shareholders May Find It Hard To Justify Increasing Bata India Limited's (NSE:BATAINDIA) CEO Compensation For Now

Key Insights

- Bata India's Annual General Meeting to take place on 12th of August

- Total pay for CEO Gunjan Dinesh Shah includes ₹34.9m salary

- The total compensation is similar to the average for the industry

- Over the past three years, Bata India's EPS grew by 48% and over the past three years, the total loss to shareholders 36%

Shareholders of Bata India Limited (NSE:BATAINDIA) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 12th of August. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Bata India

How Does Total Compensation For Gunjan Dinesh Shah Compare With Other Companies In The Industry?

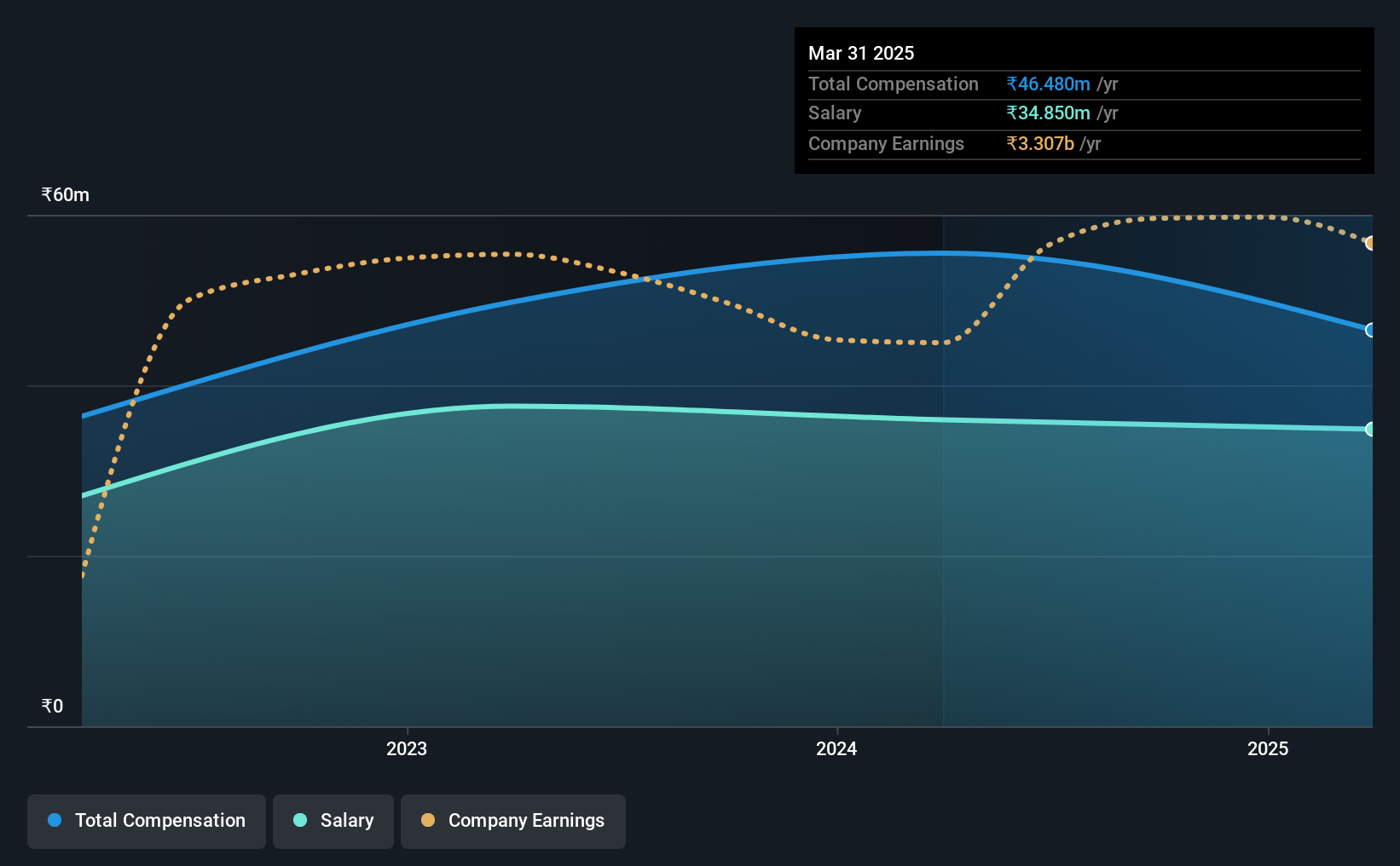

According to our data, Bata India Limited has a market capitalization of ₹153b, and paid its CEO total annual compensation worth ₹46m over the year to March 2025. That's a notable decrease of 16% on last year. In particular, the salary of ₹34.9m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Indian Luxury industry with market capitalizations ranging from ₹88b to ₹281b, the reported median CEO total compensation was ₹43m. So it looks like Bata India compensates Gunjan Dinesh Shah in line with the median for the industry.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹35m | ₹36m | 75% |

| Other | ₹12m | ₹20m | 25% |

| Total Compensation | ₹46m | ₹56m | 100% |

Speaking on an industry level, nearly 97% of total compensation represents salary, while the remainder of 3% is other remuneration. It's interesting to note that Bata India allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Bata India Limited's Growth Numbers

Over the past three years, Bata India Limited has seen its earnings per share (EPS) grow by 48% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Bata India Limited Been A Good Investment?

Few Bata India Limited shareholders would feel satisfied with the return of -36% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Bata India that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Bata India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BATAINDIA

Bata India

Manufactures, sells, and trades in footwear and accessories through its retail and wholesale network in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026