Here's Why Shareholders May Want To Be Cautious With Increasing Banswara Syntex Limited's (NSE:BANSWRAS) CEO Pay Packet

Key Insights

- Banswara Syntex to hold its Annual General Meeting on 30th of July

- Total pay for CEO Shaleen Toshniwal includes ₹18.5m salary

- The overall pay is 455% above the industry average

- Banswara Syntex's total shareholder return over the past three years was 26% while its EPS was down 21% over the past three years

Despite positive share price growth of 26% for Banswara Syntex Limited (NSE:BANSWRAS) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 30th of July. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Banswara Syntex

How Does Total Compensation For Shaleen Toshniwal Compare With Other Companies In The Industry?

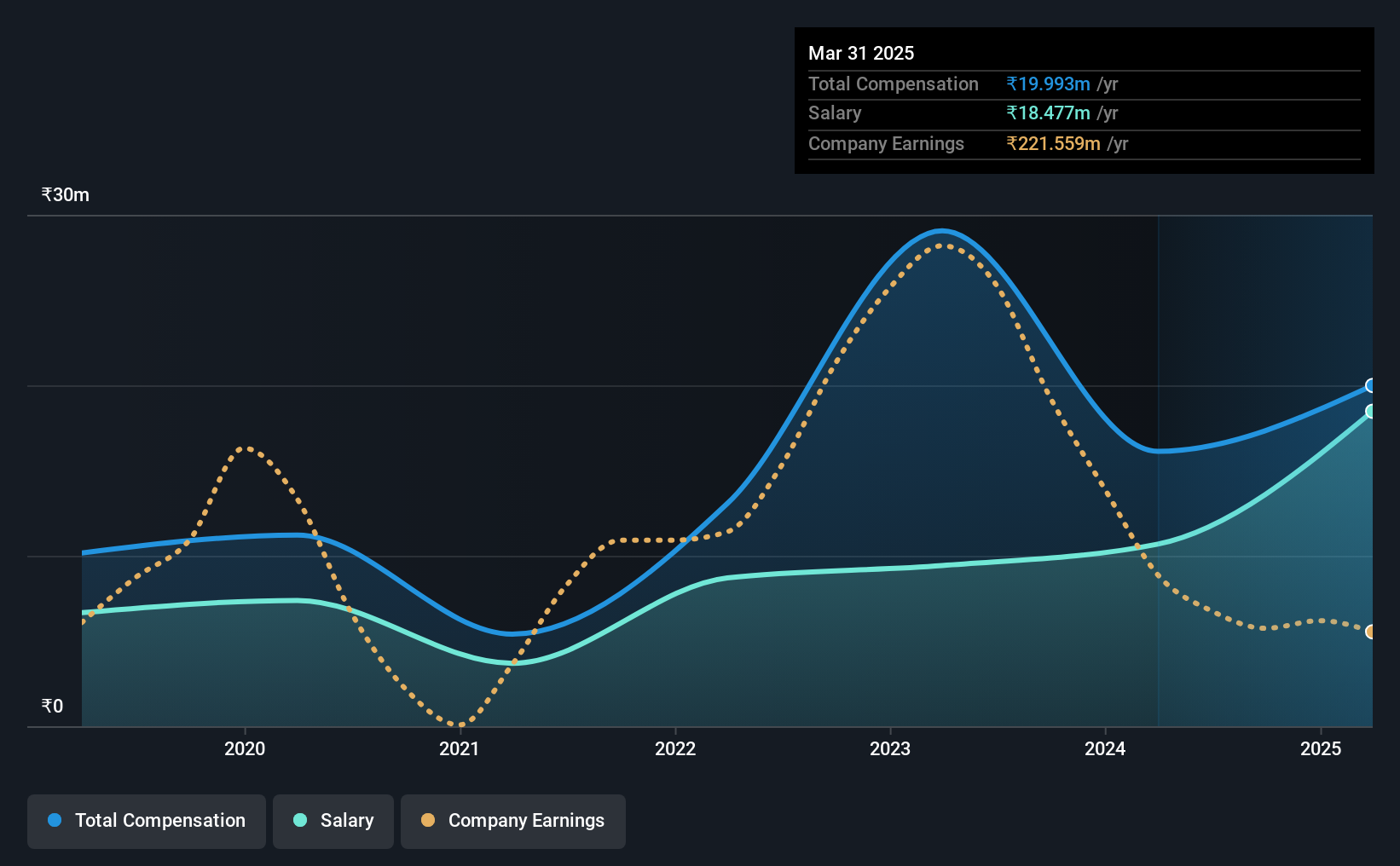

Our data indicates that Banswara Syntex Limited has a market capitalization of ₹4.8b, and total annual CEO compensation was reported as ₹20m for the year to March 2025. That's a notable increase of 24% on last year. Notably, the salary which is ₹18.5m, represents most of the total compensation being paid.

For comparison, other companies in the Indian Luxury industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹3.6m. Accordingly, our analysis reveals that Banswara Syntex Limited pays Shaleen Toshniwal north of the industry median. Moreover, Shaleen Toshniwal also holds ₹605m worth of Banswara Syntex stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹18m | ₹11m | 92% |

| Other | ₹1.5m | ₹5.4m | 8% |

| Total Compensation | ₹20m | ₹16m | 100% |

Talking in terms of the industry, salary represented approximately 98% of total compensation out of all the companies we analyzed, while other remuneration made up 2% of the pie. Although there is a difference in how total compensation is set, Banswara Syntex more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Banswara Syntex Limited's Growth

Over the last three years, Banswara Syntex Limited has shrunk its earnings per share by 21% per year. Its revenue is up 2.3% over the last year.

Overall this is not a very positive result for shareholders. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Banswara Syntex Limited Been A Good Investment?

Banswara Syntex Limited has served shareholders reasonably well, with a total return of 26% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Banswara Syntex you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banswara Syntex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BANSWRAS

Banswara Syntex

Engages in the production and sale of textile products in India and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion