Banaras Beads Limited's (NSE:BANARBEADS) Share Price Is Matching Sentiment Around Its Earnings

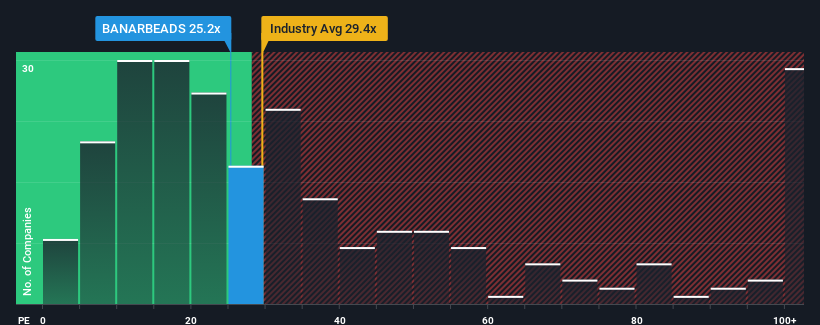

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 31x, you may consider Banaras Beads Limited (NSE:BANARBEADS) as an attractive investment with its 25.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Banaras Beads' financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Banaras Beads

Is There Any Growth For Banaras Beads?

There's an inherent assumption that a company should underperform the market for P/E ratios like Banaras Beads' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 7.5% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 24% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Banaras Beads is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Banaras Beads' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Banaras Beads maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Banaras Beads (1 is a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Banaras Beads might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BANARBEADS

Banaras Beads

Engages in the manufacture and sale of glass beads, necklaces, imitation jewelries, and other related products in India, the United States, South Africa, the United Kingdom, Ireland, Germany, Europe, the Middle East, and Africa.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives