Introducing AYM Syntex (NSE:AYMSYNTEX), The Stock That Slid 63% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

AYM Syntex Limited (NSE:AYMSYNTEX) shareholders should be happy to see the share price up 11% in the last month. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 63%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for AYM Syntex

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

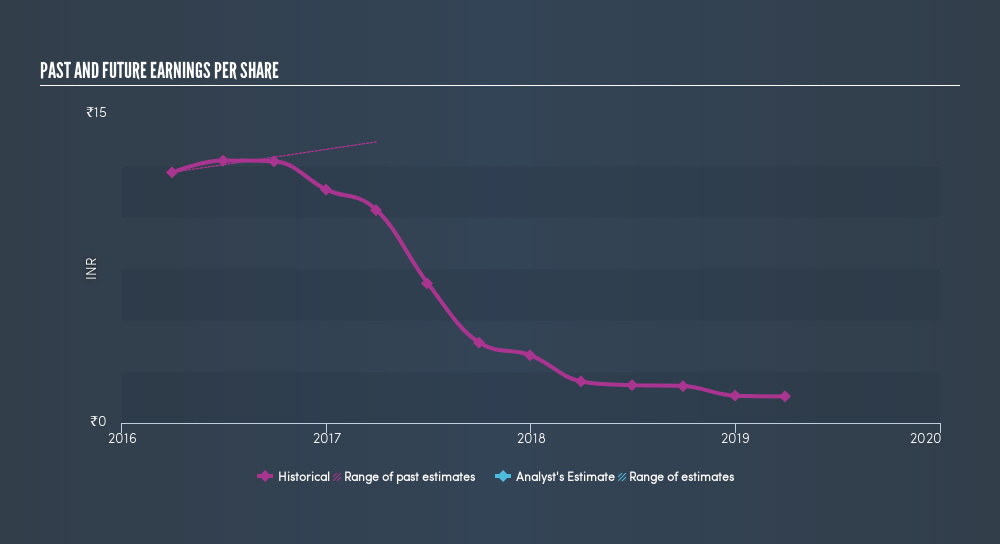

AYM Syntex saw its EPS decline at a compound rate of 53% per year, over the last three years. In comparison the 28% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into AYM Syntex's key metrics by checking this interactive graph of AYM Syntex's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for AYM Syntex shares, which cost holders 33%, while the market was up about 4.5%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 28% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before forming an opinion on AYM Syntex you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:AYMSYNTEX

AYM Syntex

Manufactures and sells polyester filament, nylon filament, and bulk continuous filament yarns for the textile and floor covering industries in India and internationally.

Moderate with adequate balance sheet.

Market Insights

Community Narratives