- India

- /

- Professional Services

- /

- NSEI:QUESS

Quess Corp Limited (NSE:QUESS) Stock's 51% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Quess Corp Limited (NSE:QUESS) shareholders that were waiting for something to happen have been dealt a blow with a 51% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

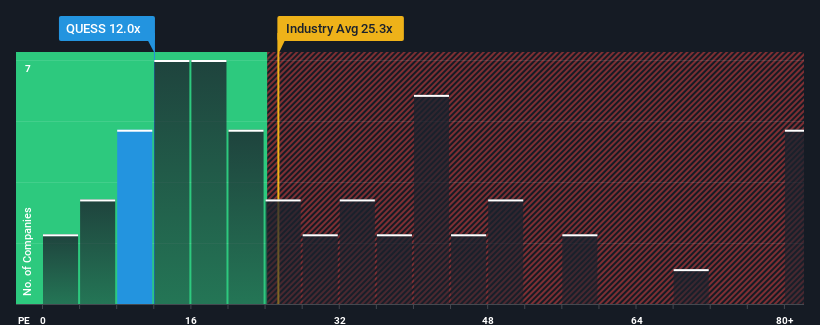

Following the heavy fall in price, Quess' price-to-earnings (or "P/E") ratio of 12x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 26x and even P/E's above 49x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Quess has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Quess

How Is Quess' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Quess' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 75% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 252% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 25%, which is not materially different.

In light of this, it's peculiar that Quess' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Quess' P/E

Shares in Quess have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Quess' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Quess (1 shouldn't be ignored!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Quess might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:QUESS

Quess

Provides staffing and workforce solutions in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives