- India

- /

- Professional Services

- /

- NSEI:MITCON

Are Dividend Investors Getting More Than They Bargained For With MITCON Consultancy & Engineering Services Limited's (NSE:MITCON) Dividend?

Is MITCON Consultancy & Engineering Services Limited (NSE:MITCON) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

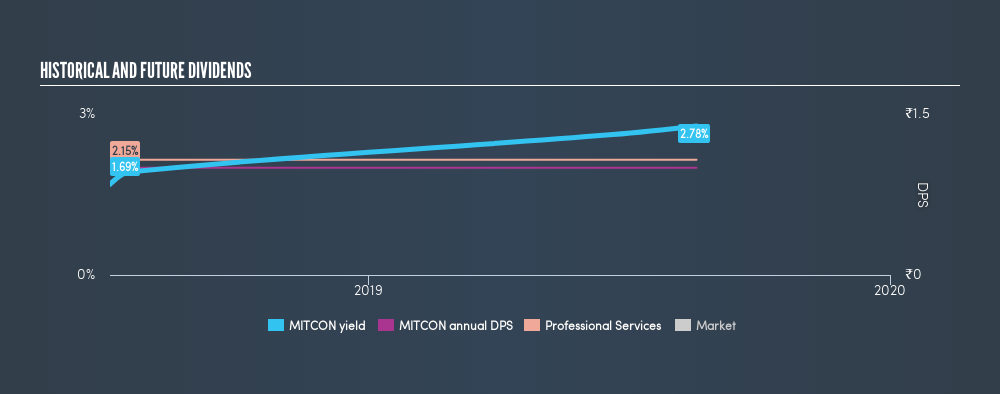

MITCON Consultancy & Engineering Services has only been paying a dividend for a year or so, so investors might be curious about its 2.8% yield. Some simple research can reduce the risk of buying MITCON Consultancy & Engineering Services for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on MITCON Consultancy & Engineering Services!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, MITCON Consultancy & Engineering Services paid out 1133% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while MITCON Consultancy & Engineering Services pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was ₹1.00 per share.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Over the past five years, it looks as though MITCON Consultancy & Engineering Services's EPS have declined at around 59% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that MITCON Consultancy & Engineering Services's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. MITCON Consultancy & Engineering Services paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Second, the company has not been able to generate earnings growth, and its history of dividend payments too short for us to thoroughly evaluate the dividend's consistency across an economic cycle. There are a few too many issues for us to get comfortable with MITCON Consultancy & Engineering Services from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Now, if you want to look closer, it would be worth checking out our free research on MITCON Consultancy & Engineering Services management tenure, salary, and performance.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:MITCON

MITCON Consultancy & Engineering Services

Provides consultancy and training services in India.

Low risk and slightly overvalued.

Market Insights

Community Narratives