Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Firstsource Solutions Limited (NSE:FSL) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Firstsource Solutions's Debt?

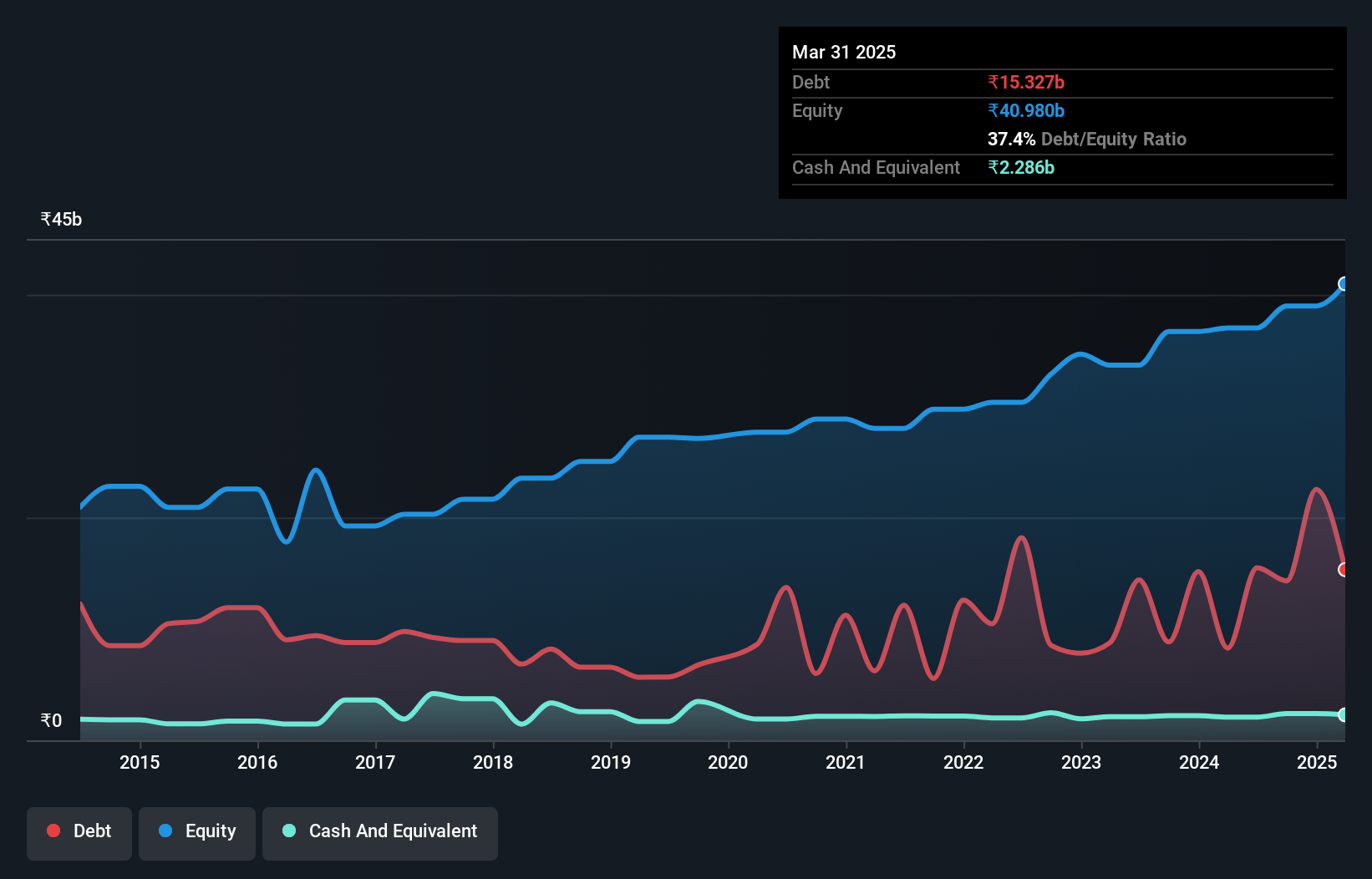

The image below, which you can click on for greater detail, shows that at March 2025 Firstsource Solutions had debt of ₹15.3b, up from ₹8.28b in one year. However, because it has a cash reserve of ₹2.29b, its net debt is less, at about ₹13.0b.

A Look At Firstsource Solutions' Liabilities

We can see from the most recent balance sheet that Firstsource Solutions had liabilities of ₹24.3b falling due within a year, and liabilities of ₹14.0b due beyond that. On the other hand, it had cash of ₹2.29b and ₹16.9b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹19.1b.

Given Firstsource Solutions has a market capitalization of ₹263.1b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

See our latest analysis for Firstsource Solutions

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Firstsource Solutions's low debt to EBITDA ratio of 1.1 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.0 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Also relevant is that Firstsource Solutions has grown its EBIT by a very respectable 26% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Firstsource Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Firstsource Solutions generated free cash flow amounting to a very robust 82% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Firstsource Solutions's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Looking at the bigger picture, we think Firstsource Solutions's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. We'd be very excited to see if Firstsource Solutions insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FSL

Firstsource Solutions

Provides tech-enabled business processes in India, the United Kingdom, the United States, the United Arab Emirates, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026