Exploring Coforge And 2 Other High Growth Tech Stocks in India

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, but over the past 12 months, it has risen by an impressive 43%, with earnings expected to grow by 17% per annum over the next few years. In this context, identifying high growth tech stocks like Coforge and others becomes crucial for investors looking to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| Coforge | 14.16% | 22.47% | ★★★★★☆ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Syrma SGS Technology | 21.85% | 31.90% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

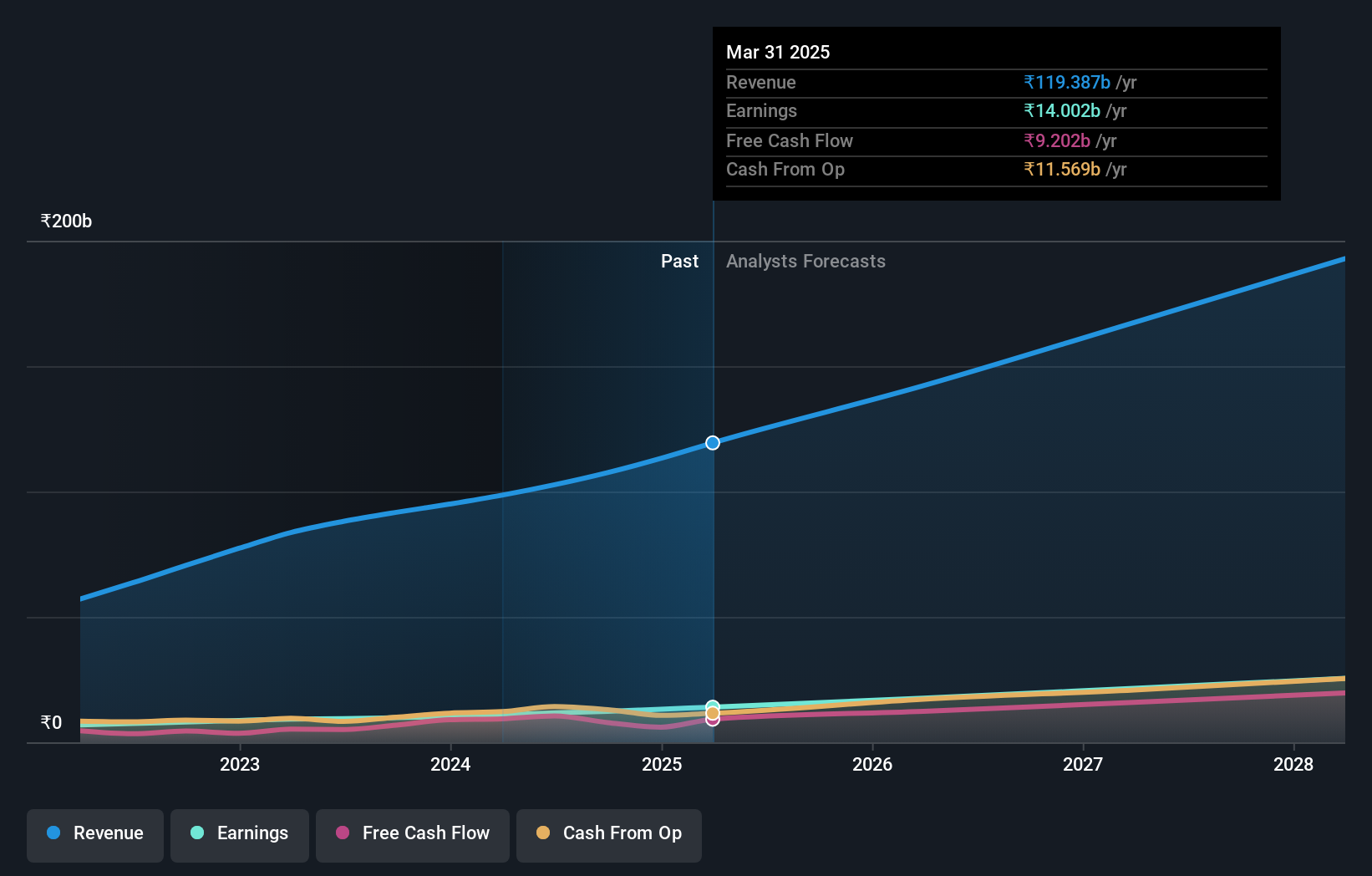

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coforge Limited provides IT and IT-enabled services across various regions, including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific, with a market cap of ₹436.93 billion.

Operations: Coforge Limited generates revenue primarily from its software solutions segment, which amounted to ₹93.59 billion. The company operates within the IT and IT-enabled services industry across multiple global regions.

Coforge's collaboration with Salesforce to launch ENZO, an environmental and net zero offering, highlights its commitment to innovation in sustainability. The company's earnings are projected to grow at 22.5% annually, outpacing the Indian market's 16.9% growth forecast. With revenue expected to rise by 14.2% per year and a strong focus on R&D investments—totaling ₹1.5 billion last year—Coforge is well-positioned for future growth in the tech sector while addressing critical environmental challenges through advanced AI solutions.

- Delve into the full analysis health report here for a deeper understanding of Coforge.

Review our historical performance report to gain insights into Coforge's's past performance.

Firstsource Solutions (NSEI:FSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Firstsource Solutions Limited provides tech-enabled business processes in the United Kingdom, the United States, Asia, and internationally with a market cap of ₹220.53 billion.

Operations: The company generates revenue primarily from four segments: Healthcare (₹22.27 billion), Banking and Financial Services (BFS) (₹25.11 billion), Communication, Media and Technology (CMT) (₹14.76 billion), and Diverse Industries (₹3.75 billion). The BFS segment is the largest contributor to revenue, followed by Healthcare and CMT.

Firstsource Solutions' recent launch of Firstsource relAI, a suite of AI-led platforms, underscores its commitment to driving digital transformation across various sectors. With projected revenue growth at 12.3% annually and earnings growth expected at 19.9%, the company is set to outpace the Indian market's average. Notably, their R&D expenses totaled ₹1 billion last year, reflecting a strategic focus on innovation. Clients in HealthTech have seen Medicaid conversion rates improve by 22%, while FinTech clients reduced operational costs by up to 50%.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited provides software products, services, and technology solutions in India, North America, and internationally with a market cap of ₹773.38 billion.

Operations: The company generates revenue primarily from three segments: Healthcare & Life Sciences (₹23.88 billion), Software, Hi-Tech and Emerging Industries (₹46.41 billion), and Banking, Financial Services and Insurance (BFSI) (₹32.08 billion). The largest revenue stream comes from the Software, Hi-Tech and Emerging Industries segment.

Persistent Systems has demonstrated robust growth, with earnings projected to rise by 19.2% annually, outpacing the broader Indian market's 16.9%. The company reported a significant revenue increase to ₹27.68 billion for Q1 2024 from ₹23.43 billion a year ago, highlighting its strong performance in the IT sector. Persistent's strategic focus on innovation is evident from its R&D expenditure of ₹1 billion last year, supporting initiatives like the GenAI Hub platform that accelerates AI application development across enterprises.

Next Steps

- Unlock our comprehensive list of 38 Indian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:COFORGE

Coforge

Provides information technology (IT) and IT-enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives