- India

- /

- Professional Services

- /

- NSEI:FSL

Earnings Tell The Story For Firstsource Solutions Limited (NSE:FSL) As Its Stock Soars 26%

Despite an already strong run, Firstsource Solutions Limited (NSE:FSL) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 107% following the latest surge, making investors sit up and take notice.

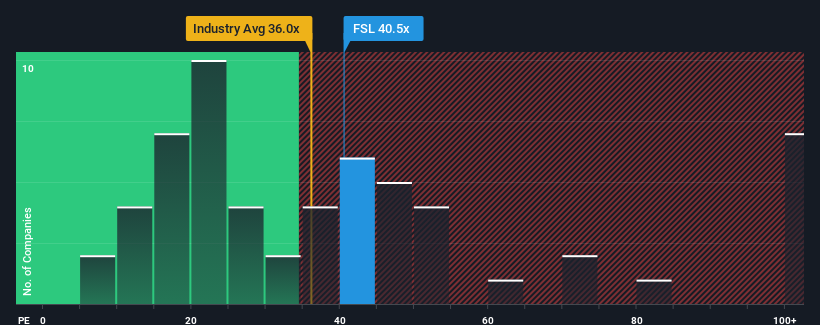

Since its price has surged higher, Firstsource Solutions may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 40.5x, since almost half of all companies in India have P/E ratios under 32x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Firstsource Solutions' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Firstsource Solutions

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Firstsource Solutions' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.2% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 23% per year over the next three years. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader market.

In light of this, it's understandable that Firstsource Solutions' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Firstsource Solutions' P/E

Firstsource Solutions shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Firstsource Solutions' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Firstsource Solutions that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FSL

Firstsource Solutions

Provides tech-enabled business processes in India, the United Kingdom, the United States, the United Arab Emirates, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion